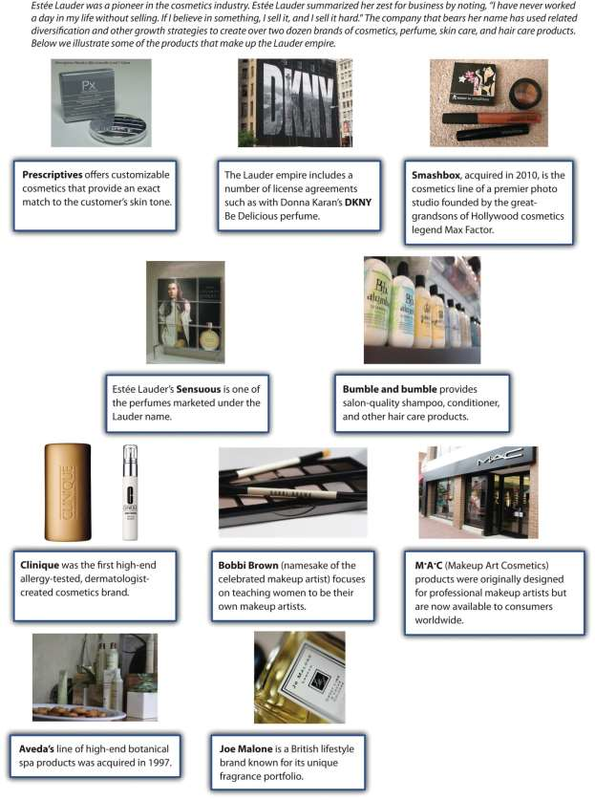

Related diversification occurs when a firm moves into a new industry that has important similarities with the firm’s existing industry or industries (Figure 8.10 The Sweet Fragrance of Success: The Brands That “Make Up” the Lauder Empire ). Because films and television are both aspects of entertainment, Disney’s purchase of ABC is an example of related diversification. Some firms that engage in related diversification aim to develop and exploit acore competency to become more successful. A core competency is a skill set that is difficult for competitors to imitate, can be leveraged in different businesses, and contributes to the benefits enjoyed by customers within each business. 1For example, Newell Rubbermaid is skilled at identifying underperforming brands and integrating them into their three business groups: (1) home and family, (2) office products, and (3) tools, hardware, and commercial products.

Honda Motor Company provides a good example of leveraging a core competency through related diversification. Although Honda is best known for its cars and trucks, the company actually started out in the motorcycle business. Through competing in this business, Honda developed a unique ability to build small and reliable engines. When executives decided to diversify into the automobile industry, Honda was successful in part because it leveraged this ability within its new business. Honda also applied its engine-building skills in the all-terrain vehicle, lawn mower, and boat motor industries.

Sometimes the benefits of related diversification that executives hope to enjoy are never achieved. Both soft drinks and cigarettes are products that consumers do not need. Companies must convince consumers to buy these products through marketing activities such as branding and advertising. Thus, on the surface, the acquisition of 7Up by Philip Morris seemed to offer the potential for Philip Morris to take its existing marketing skills and apply them within a new industry. Unfortunately, the possible benefits to 7Up never materialized.

- 11763 reads