The fact that price in monopoly exceeds marginal cost suggests that the monopoly solution violates the basic condition for economic efficiency, that the price system must confront decision makers with all of the costs and all of the benefits of their choices. Efficiency requires that consumers confront prices that equal marginal costs. Because a monopoly firm charges a price greater than marginal cost, consumers will consume less of the monopoly’s good or service than is economically efficient.

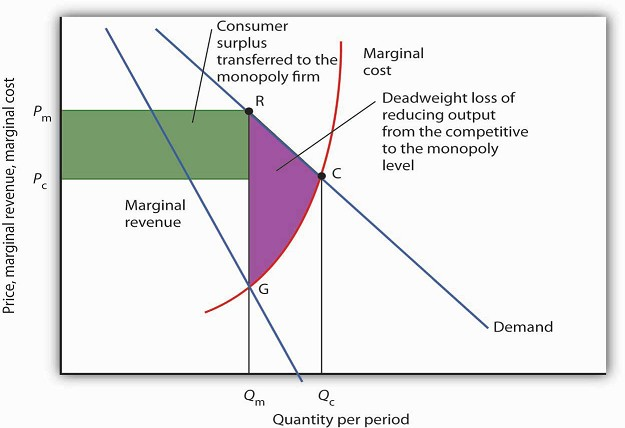

To contrast the efficiency of the perfectly competitive outcome with the inefficiency of the monopoly outcome, imagine a perfectly competitive industry whose solution is depicted in Figure 10.9. The short-run industry supply curve is the summation of individual marginal cost curves; it may be regarded as the marginal cost curve for the industry. A perfectly competitive industry achieves equilibrium at point C, at price Pc and quantity Qc.

Given market demand and marginal revenue, we can compare the behavior of a monopoly to that of a perfectly competitive industry. The marginal cost curve may be thought of as the supply curve of a perfectly competitive industry. The perfectly competitive industry produces quantity Qc and sells the output at price Pc. The monopolist restricts output to Qm and raises the price to Pm. Reorganizing a perfectly competitive industry as a monopoly results in a deadweight loss to society given by the shaded area GRC. It also transfers a portion of the consumer surplus earned in the competitive case to the monopoly firm.

Now, suppose that all the firms in the industry merge and a government restriction prohibits entry by any new firms. Our perfectly competitive industry is now a monopoly. Assume the monopoly continues to have the same marginal cost and demand curves that the competitive industry did. The monopoly firm faces the same market demand curve, from which it derives its marginal revenue curve. It maximizes profit at output Qm and charges price Pm. Output is lower and price higher than in the competitive solution.

Society would gain by moving from the monopoly solution at Qm to the competitive solution at Qc. The benefit to consumers would be given by the area under the demand curve between Qm and Qc; it is the area QmRCQc. An increase in output, of course, has a cost. Because the marginal cost curve measures the cost of each additional unit, we can think of the area under the marginal cost curve over some range of output as measuring the total cost of that output. Thus, the total cost of increasing output from Qm to Qc is the area under the marginal cost curve over that range—the area QmGCQc. Subtracting this cost from the benefit gives us the net gain of moving from the monopoly to the competitive solution; it is the shaded area GRC. That is the potential gain from moving to the efficient solution. The area GRC is a deadweight loss.

- 1559 reads