Just as the increase in income inequality begs for explanation, so does the question of why poverty seems so persistent. Should not the long periods of economic growth in the 1980s and 1990s and since 2003 have substantially reduced poverty? Have the various government programs been ineffective?

Clearly, some of the same factors that have contributed to rising income inequality have also contributed to the persistence of poverty. In particular, the increases in households headed by females and the growing gaps in wages between skilled and unskilled workers have been major contributors.

Tax policy changes have reduced the extent of poverty. In addition to general reductions in tax rates, the Earned Income Tax Credit, which began in 1975 and was expanded in the 1990s, provides people below a certain income level with a supplement for each dollar of income earned. This supplement, roughly 30 cents for every dollar earned, is received as a tax refund at the end of the year.

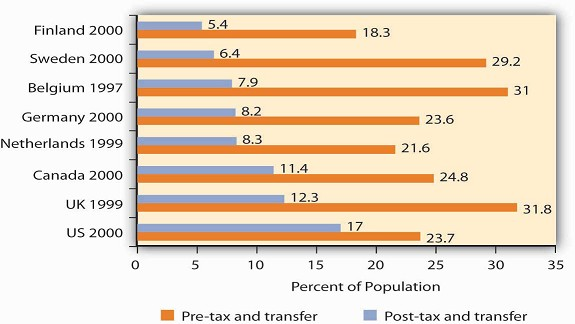

Source: Timothy M. Smeeding, “Public Policy, Economic Inequality, and Poverty: The United States in Comparative Perspectives,” Social Science Quarterly, 86 (December 2005): 955–983.

Taken together, though, transfer payment and tax programs in the United States are less effective in reducing poverty that are the programs of other developed countries. Figure Figure 19.6 shows the percentage of the population in eight developed countries with a disposable income (income after taxes) less than one-half the national median. The exhibit shows this percentage both before and after tax and transfer payment programs are considered. Clearly, the United States is the least aggressive in seeking to eliminate poverty among the eight countries shown.

- 1348 reads