What difference does it make if the average level of prices changes? First, consider the impact of inflation.

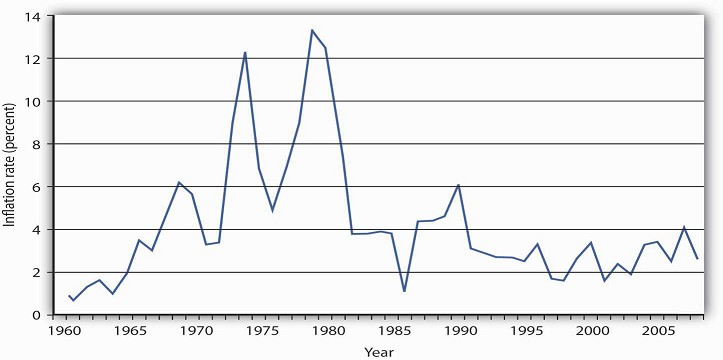

Inflation is measured as the annual rate of increase in the average level of prices. Figure Figure 20.3 shows how volatile inflation has been in the United States over the past four decades. In the 1960s the inflation rate rose, and it became dramatically worse in the 1970s. The inflation rate plunged in the 1980s and continued to ease downward in the 1990s. It remained low in the early 2000s and began to accelerate in 2007 and during most of 2008.

Source: Bureau of Labor Statistics, All Urban Consumers CPI-U, 1982–84 = 100, Dec.–Dec. inflation rate. Data for 2008 is through October.

Whether one regards inflation as a “good” thing or a “bad” thing depends very much on one’s economic situation. If you are a borrower, unexpected inflation is a good thing—it reduces the value of money that you must repay. If you are a lender, it is a bad thing because it reduces the value of future payments you will receive. Whatever any particular person’s situation may be, inflation always produces the following effects on the economy: it reduces the value of money and it reduces the value of future monetary obligations. It can also create uncertainty about the future.

Suppose that you have just found a $10 bill you stashed away in 1990. Prices have increased by about 50% since then; your money will buy less than what it would have purchased when you put it away. Your money has thus lost value.

Money loses value when its purchasing power falls. Since inflation is a rise in the level of prices, the amount of goods and services a given amount of money can buy falls with inflation.

Just as inflation reduces the value of money, it reduces the value of future claims on money. Suppose you have borrowed $100 from a friend and have agreed to pay it back in one year. During the year, however, prices double. That means that when you pay the money back, it will buy only half as much as it could have bought when you borrowed it. That is good for you but tough on the person who lent you the money. Of course, if you and your friend had anticipated such rapid inflation, you might have agreed to pay back a larger sum to adjust for it. When people anticipate inflation, they can adjust for its consequences in determining future obligations. But unanticipated inflation helps borrowers and hurts lenders.

Inflation’s impact on future claims can be particularly hard on people who must live on a fixed income, that is, on an income that is predetermined through some contractual arrangement and does not change with economic conditions. An annuity, for example, typically provides a fixed stream of money payments. Retirement pensions sometimes generate fixed income. Inflation erodes the value of such payments.

Given the danger posed by inflation for people on fixed incomes, many retirement plans provide for indexed payments. An indexed payment is one whose dollar amount changes with the rate of change in the price level. If a payment changes at the same rate as the rate of change in the price level,the purchasing power of the payment remains constant. Social Security payments, for example, are indexed to maintain their purchasing power.

Because inflation reduces the purchasing power of money, the threat of future inflation can make people reluctant to lend for long periods. From a lender’s point of view, the danger of a long-term commitment of funds is that future inflation will wipe out the value of the amount that will eventually be paid back. Lenders are reluctant to make such commitments.

Uncertainty can be particularly pronounced in countries where extremely high inflation is a threat. Hyperinflation is generally defined as an inflation rate in excess of 200% per year. Inflation of that magnitude erodes the value of money very quickly. Hyperinflations occurred in Germany in the 1920s and in Yugoslavia in the early 1990s. There are stories about how people in Germany during the hyperinflation brought wheelbarrows full of money to stores to pay for ordinary items. In Yugoslavia in 1993 there was a report of a shop owner barring the entrance to his store with a mop while he changed his prices.

The inflation rate rose to an astronomical rate in 2008 in Zimbabwe. As the government printed more money and put it in circulation, prices rose. When inflation began to accelerate, the government found it “necessary” to print more and more money, causing prices to rise very fast. The inflation rate in Zimbabwe reached an astonishing 11.2 million percent in July of 2008, according to Zimbabwe’s Central Statistics Office. A loaf of bread cost 200,000 Zimbabwe dollars in February 2008. That same loaf cost 1.6 trillion Zimbabwe dollars by August.

Do the problems associated with inflation imply that deflation would be a good thing? The answer is simple: no. Like inflation, deflation changes the value of money and the value of future obligations. It also creates uncertainty about the future.

If there is deflation, the real value of a given amount of money rises. In other words, if there had been deflation since 2000, a $10 bill you had stashed away in 2000 would buy more goods and services today. That sounds good, but should you buy $10 worth of goods and services now when you would be able to buy even more for your $10 in the future if the deflation continues? When Japan experienced deflation in the late 1990s and early 2000s, Japanese consumers seemed to be doing just that—waiting to see if prices would fall further. They were spending less per person and, as we will see throughout our study of macroeconomics, less consumption often meant less output, fewer jobs, and the prospect of a recurring recessions.

And, if you had to use the $10 to pay back a debt you owed, the purchasing power of your money would be higher than when you borrowed the money. The lender would feel good about being able to buy more with the $10 than you were able to, but you would feel like you had gotten a raw deal.

Unanticipated deflation hurts borrowers and helps lenders. If the parties anticipate the deflation, a loan agreement can be written to reflect expected changes in the price level.

The threat of deflation can make people reluctant to borrow for long periods. Borrowers become reluctant to enter into long-term contracts because they fear that deflation will raise the value of the money they must pay back in the future. In such an environment, firms may be reluctant to borrow to build new factories, for example. This is because they fear that the prices at which they can sell their output will drop, making it difficult for them to repay their loans.

Deflation was common in the United States in the latter third of the 19th century. In the 20th century, there was a period of deflation after World War I and again during the Great Depression in the 1930s.

- 1439 reads