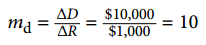

We can relate the potential increase in the money supply to the change in reserves that created it using the deposit multiplier (md), which equals the ratio of the maximum possible change in checkable deposits (ΔD) to the change in reserves (ΔR). In our example, the deposit multiplier was 10:

EQUATION 24.1

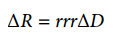

To see how the deposit multiplier md is related to the required reserve ratio, we use the fact that if banks in the economy are loaned up, then reserves, R, equal the required reserve ratio (rrr) times checkable deposits, D:

EQUATION 24.2

R = rrrD

A change in reserves produces a change in loans and a change in checkable deposits. Once banks are fully loaned up, the change in reserves, ΔR, will equal the required reserve ratio times the change in deposits, ΔD:

EQUATION 24.3

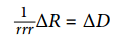

Solving for ΔD, we have

EQUATION 24.4

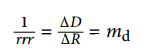

Dividing both sides by ΔR, we see that the deposit multiplier, md, is 1/rrr:

EQUATION 24.5

The deposit multiplier is thus given by the reciprocal of the required reserve ratio. With a required reserve ratio of 0.1, the deposit multiplier is 10. A required reserve ratio of 0.2 would produce a deposit multiplier of 5. The higher the required reserve ratio, the lower the deposit multiplier.

Actual increases in checkable deposits will not be nearly as great as suggested by the deposit multiplier.That is because the artificial conditions of our example are not met in the real world. Some banks hold excess reserves, customers withdraw cash, and some loan proceeds are not spent. Each of these factors reduces the degree to which checkable deposits are affected by an increase in reserves. The basic mechanism, however, is the one described in our example, and it remains the case that checkable deposits increase by a multiple of an increase in reserves.

The entire process of money creation can work in reverse. When you withdraw cash from your bank, you reduce the bank’s reserves. Just as a deposit at Acme Bank increases the money supply by a multiple of the original deposit, your withdrawal reduces the money supply by a multiple of the amount you withdraw. And just as money is created when banks issue loans, it is destroyed as the loans are repaid. A loan payment reduces checkable deposits; it thus reduces the money supply.

Suppose, for example, that the Acme Bank customer who borrowed the $900 makes a $100 payment on the loan. Only part of the payment will reduce the loan balance; part will be interest. Suppose $30 of the payment is for interest, while the remaining $70 reduces the loan balance. The effect of the payment on Acme’s balance sheet is shown below. Checkable deposits fall by $100, loans fall by $70,and net worth rises by the amount of the interest payment, $30.

Similar to the process of money creation, the money reduction process decreases checkable deposits by, at most, the amount of the reduction in deposits times the deposit multiplier.

- 1422 reads