To reduce the number of bank failures, banks are severely limited in what they can do. They are barred from certain types of financial investments and from activities viewed as too risky. Banks are required to maintain a minimum level of net worth as a fraction of total assets. Regulators from the FDIC regularly perform audits and other checks of individual banks to ensure they are operating safely.

The FDIC has the power to close a bank whose net worth has fallen below the required level. In practice, it typically acts to close a bank when it becomes insolvent, that is, when its net worth becomes negative. Negative net worth implies that the bank’s liabilities exceed its assets.

When the FDIC closes a bank, it arranges for depositors to receive their funds. When the bank’s funds are insufficient to return customers’ deposits, the FDIC uses money from the insurance fund for this purpose. Alternatively, the FDIC may arrange for another bank to purchase the failed bank. The FDIC, however, continues to guarantee that depositors will not lose any money.

KEY TAKEAWAYS

- Banks are financial intermediaries that accept deposits, make loans, and provide checking accounts for their customers.

- Money is created within the banking system when banks issue loans; it is destroyed when the loans are repaid.

- An increase (decrease) in reserves in the banking system can increase (decrease) the money supply. The maximum amount of the increase (decrease) is equal to the deposit multiplier times the change in reserves; the deposit multiplier equals the reciprocal of the required reserve ratio.

- Bank deposits are insured and banks are heavily regulated.

TRY IT!

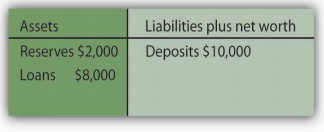

- Suppose Acme Bank initially has $10,000 in deposits, reserves of $2,000, and loans of $8,000. At a required reserve ratio of 0.2, is Acme loaned up? Show the balance sheet of Acme Bank at present.

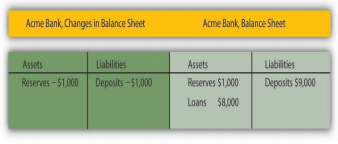

- Now suppose that an Acme Bank customer, planning to take cash on an extended college graduation trip to India, withdraws $1,000 from her account. Show the changes to Acme Bank’s balance sheet and Acme’s balance sheet after the withdrawal. By how much are its reserves now deficient?

- Acme would probably replenish its reserves by reducing loans. This action would cause a multiplied contraction of checkable deposits as other banks lose deposits because their customers would be paying off loans to Acme. How large would the contraction be?

Case in Point: A Big Bank Goes Under

It was the darling of Wall Street—it showed rapid growth and made big profits. Washington Mutual, a savings and loan based in the state of Washington, was a relatively small institution whose

CEO, Kerry K. Killinger, had big plans. He wanted to transform his little Seattle S&L into the Wal-Mart of banks. Mr. Killinger began pursuing a relatively straightforward strategy. He

acquired banks in large cities such as Chicago and Los Angeles. He acquired banks up and down the east and west coasts. He aggressively extended credit to low-income individuals and

families—credit cards, car loans, and mortgages. In making mortgage loans to low-income families, WaMu, as the bank was known, quickly became very profitable. But it was exposing itself to

greater and greater risk, according to the New York Times. Housing prices in the United States more than doubled between 1997 and 2007. During that time, loans to even low-income households

were profitable. But, as housing prices began falling in 2007, banks such as WaMu began to experience losses as homeowners began to walk away from houses whose values suddenly fell below

their outstanding mortgages. WaMu began losing money in 2007 as housing prices began falling. The company had earned $3.6 billion in 2006, and swung to a loss of $67 million in 2007,

according to the Puget Sound Business Journal. Mr. Killinger was ousted by the board early in September of 2008. The bank failed later that month. It was the biggest bank failure in the

history of the United States. The Federal Deposit Insurance Corporation (FDIC) had just rescued another bank, IndyMac, which was only a tenth the size of WaMu, and would have done the same

for WaMu if it had not been able to find a company to purchase it. But in this case, JPMorgan Chase agreed to take it over—its deposits, bank branches, and its troubled asset portfolio. The

government and the Fed even negotiated the deal behind WaMu’s back! The then chief executive officer of the company, Alan H. Fishman, was reportedly flying from New York to Seattle when the

deal was finalized. The government was anxious to broker a deal that did not require use of the FDIC’s depleted funds following IndyMac’s collapse. But it would have done so if a buyer had

not been found. As the FDIC reports on its Web site: “Since the FDIC’s creation in 1933, no depositor has ever lost even one penny of FDIC-insured funds.”

Sources: Eric Dash and Andrew Ross Sorkin, “Government Seizes WaMu and Sells Some Assets,” The New York Times, September 25, 2008, p. A1; Kirsten Grind, “Insiders Detail Reasons for

WaMu’s Failure,” Puget Sound Business Journal, January 23, 2009; and FDIC Web site at https://www.fdic.gov/edie/fdic_info.html.

ANSWER TO TRY IT! PROBLEM

- Acme Bank is loaned up, since $2,000/$10,000 = 0.2, which is the required reserve ratio. Acme’s balance sheet is:

- Acme Bank’s balance sheet after losing $1,000 in deposits:

Required reserves are deficient by $800. Acme must hold 20% of

its deposits, in this case $1,800 (0.2 × $9,000 = $1,800), as reserves, but it has only $1,000 in reserves at the moment.

Required reserves are deficient by $800. Acme must hold 20% of

its deposits, in this case $1,800 (0.2 × $9,000 = $1,800), as reserves, but it has only $1,000 in reserves at the moment.

- The contraction in checkable deposits would be ΔD = (1 / 0.2) × ( − $1,000) = − $5,000

- 13796 reads