As capital is used, some of it wears out or becomes obsolete; it depreciates (the Commerce Department reports depreciation as “consumption of fixed capital”). Investment adds to the capital stock, and depreciation reduces it. Gross investment minus depreciation is net investment. If gross investment is greater than depreciation in any period, then net investment is positive and the capital stock increases. If gross investment is less than depreciation in any period, then net investment is negative and the capital stock declines.

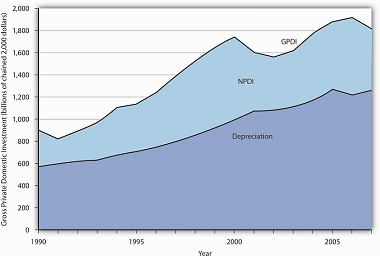

In the official estimates of total output, gross investment (GPDI) minus depreciation equals net private domestic investment (NPDI). The value for NPDI in any period gives the amount by which the privately held stock of physical capital increased during that period.

Figure 29.2 reports the real values of GPDI, depreciation, and NPDI from 1990 to 2007. We see that the bulk of GPDI replaces capital that has been depreciated. Notice the sharp reductions in NPDI during the recessions of 1990–1991, 2001, and 2007.

The bulk of gross private domestic investment goes to the replacement of capital that has depreciated, as shown by the experience of the past two decades.

Source: Bureau of Economic Analysis, NIPA Table 5.2.6 (revised August 8, 2008).

- 1370 reads