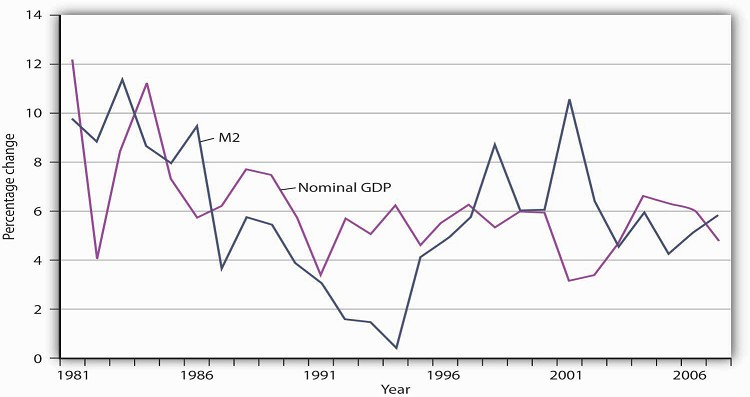

Look again at Figure 32.6. The close relationship between M2 and nominal GDP in the 1960s and 1970s helped win over many economists to the monetarist camp. Now look at Figure 32.10. It shows the same two variables, M2 and nominal GDP, from the 1980s through 2007. The tidy relationship between the two seems to have vanished. What happened?

The close relationship between M2 and nominal GDP a year later that had prevailed in the 1960s and 1970s seemed to vanish from the 1980s onward.

The sudden change in the relationship between the money stock and nominal GDP has resulted partly from public policy. Deregulation of the banking industry in the early 1980s produced sharp changes in the ways individuals dealt with money, thus changing the relationship of money to economic activity. Banks have been freed to offer a wide range of financial alternatives to their customers. One of the most important developments has been the introduction of bond funds offered by banks. These funds allowed customers to earn the higher interest rates paid by long-term bonds while at the same time being able to transfer funds easily into checking accounts as needed. Balances in these bond funds are not counted as part of M2. As people shifted assets out of M2 accounts and into bond funds, velocity rose. That changed the once-close relationship between changes in the quantity of money and changes in nominal GDP.

Many monetarists have argued that the experience of the 1980s, 1990s, and 2000s reinforces their view that the instability of velocity in the short run makes monetary policy an inappropriate tool for short-run stabilization. They continue to insist, however, that the velocity of M2 remains stable in the long run. But the velocity of M2 appears to have diverged in recent years from its long-run path. Although it may return to its long-run level, the stability of velocity remains very much in doubt. Because of this instability, in 2000, when the Fed was no longer required by law to report money target ranges, it discontinued the practice.

- 944 reads