Basically, economics assumes that the consumer is a rational decision maker and has perfect information. Therefore, if a price for a particular product goes up and the customer is aware of all relevant information, demand will be reduced for that product. Should price decline, demand would increase. That is, the quantity demanded typically rises causing a downward sloping demand curve.

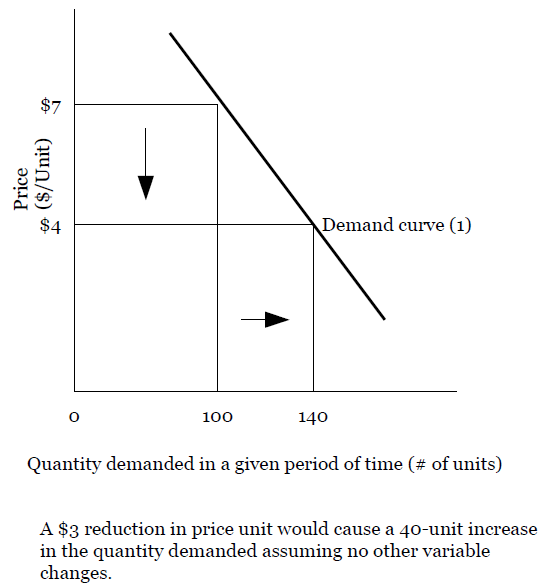

A demand curve shows the quantity demanded at various price levels (see Figure 9.2). As a seller changes the price requested to a lower level, the product or service may become an attractive use of financial resources to a larger number of buyers, thus expanding the total market for the item. This total market demand by all buyers for a product type (not just for the company's own brand name) is called primary demand. Additionally, a lower price may cause buyers to shift purchases from competitors, assuming that the competitors do not meet the lower price. If primary demand does not expand and competitors meet the lower price the result will be lower total revenue for all sellers.

Since, in the US, we operate as a free market economy, there are few instances when someone outside the organization controls a product's price. Even commodity-like products such as air travel, gasoline, and telecommunications, now determine their own prices. Because large companies have economists on staff and buy into the assumptions of economic theory as it relates to price, the classic price-demand relationship dictates the economic health of most societies. The Chairman of the US Federal Reserve determines interest rates charged by banks as well as the money supply, thereby directly affecting price (especially of stocks and bonds). He is considered by many to be the most influential person in the world.

- 1826 reads