Available under Creative Commons-ShareAlike 4.0 International License.

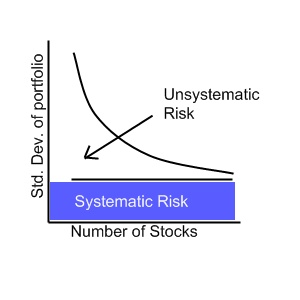

Unsystematic risk is also called idiosyncratic risk, or diversifiable risk. It represents the risk of a security that is unrelated to the market in general. Unsystematic risk can be reduced by holding a diversified portfolio. A diversified portfolio eliminates the likelihood of one isolated event causing a large decrease in portfolio value.

As you can see from the above image, as the number of stocks in a portfolio increase, the amount of unsystematic risk approaches zero. However, it is impossible to remove systematic risk, as it concerns the economy in general.

- 瀏覽次數:3170