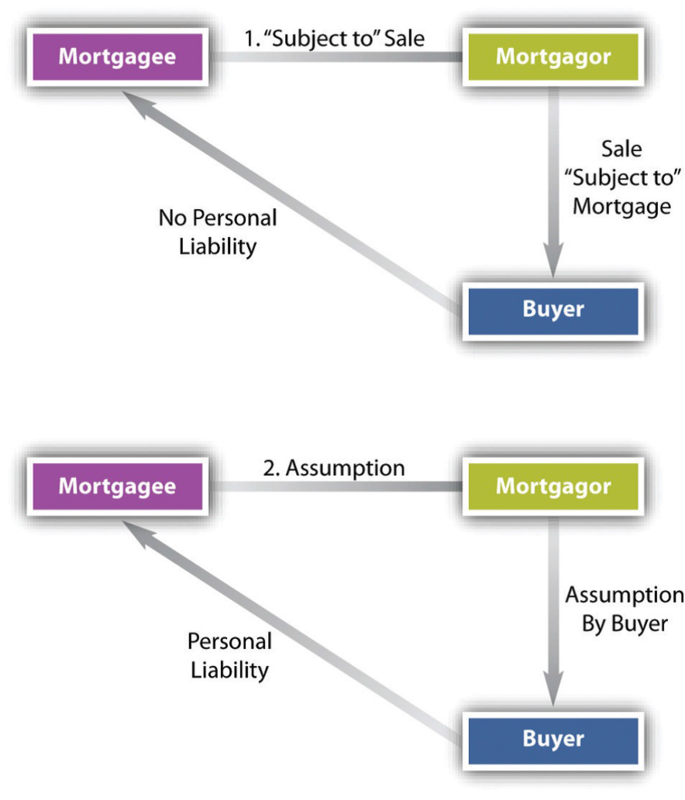

The property can be sold without paying off the mortgage if the mortgage is assumed by the new buyer, who agrees to pay the seller’s (the original mortgagor’s) debt. This is a novation if, in approving the assumption, the bank releases the old mortgagor and substitutes the buyer as the new debtor.

The buyer need not assume the mortgage. If the buyer purchases the property without agreeing to be personally liable, this is a sale “subject to” the mortgage (see Figure 34.3). In the event of the seller’s subsequent default, the bank can foreclose the mortgage and sell the property that the buyer has purchased, but the buyer is not liable for any deficiency.

What if mortgage rates are high? Can buyers assume an existing low-rate mortgage from the seller rather than be forced to obtain a new mortgage at substantially higher rates? Banks, of course, would prefer not to allow that when interest rates are rising, so they often include in the mortgage a due-on-sale clause, by which the entire principal and interest become due when the property is sold, thus forcing the purchaser to get financing at the higher rates. The clause is a device for preventing subsequent purchasers from assuming loans with lower-than-market interest rates. Although many state courts at one time refused to enforce the due-on-sale clause, Congress reversed this trend when it enacted the Garn–St. Germain Depository Institutions Act in 1982. 1 The act preempts state laws and upholds the validity of due-on-sale clauses. When interest rates are low, banks have no interest in enforcing such clauses, and there are ways to work around the due-on-sale clause.

- 1840 reads