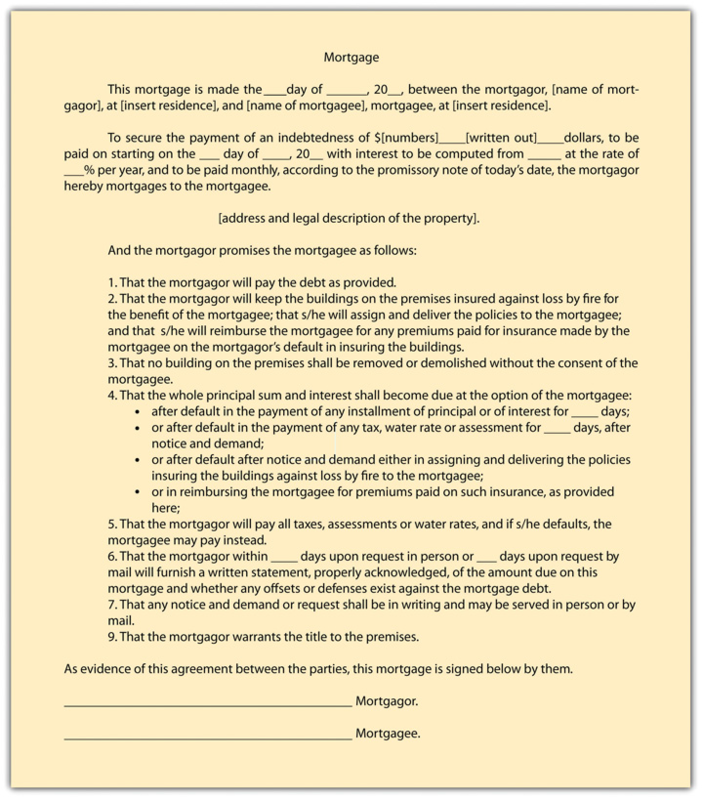

Under the statute of frauds, the mortgage itself must be evidenced by some writing to be enforceable. The mortgagor will usually make certain promises and warranties to the mortgagee and state the amount and terms of the debt and the mortgagor’s duties concerning taxes, insurance, and repairs. A sample mortgage form is presented in Figure 34.2.

KEY TAKEAWAY

As a mechanism of security, a mortgage is a promise by the debtor (mortgagor) to repay the creditor (mortgagee) for the amount borrowed or credit extended, with real estate put up as security. If the mortgagor doesn’t pay as promised, the mortgagee may repossess the real estate. Mortgage law has ancient roots and brings with it various permutations on the theme that even if the mortgagor defaults, she may nevertheless have the right to get the property back or at least be reimbursed for any value above that necessary to pay the debt and the expenses of foreclosure. Mortgage law is regulated by state and federal statute.

EXERCISES

- What role did the right of redemption play in courts of equity changing the substance of a mortgage from an actual transfer of title to the mortgagee to a mere lien on the property?

- What abuses did the federal RESPA address?

- What are the two documents most commonly associated with mortgage transactions?

- 2577 reads