Determining the priority of liabilities can be problematic. For instance, debts might be incurred to both outside creditors and partners, who might have lent money to pay off certain accounts or for working capital.

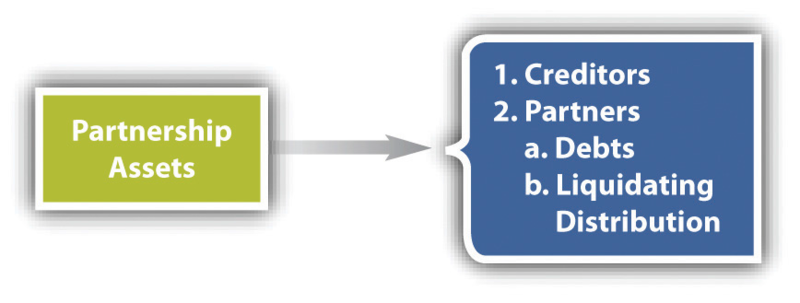

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and finally (4) to partners for their share of profits (see Figure 23.3). However, RUPA eliminates the distinction between capital and profits when the firm pays partners what is owed to them; RUPA Section 807(b) speaks simply of the right of a partner to a liquidating distribution.

Partners are entitled to share equally in the profits and surplus remaining after all liabilities, including those owed to partners, are paid off, although the partnership agreement can state a different share—for example, in proportion to capital contribution. If after winding up there is a net loss, whether capital or otherwise, each partner must contribute toward it in accordance with his share in the profits, had there been any, unless the agreement states otherwise. If any of the partners is insolvent or refuses to contribute and cannot be sued, the others must contribute their own share to pay off the liabilities and in addition must contribute, in proportion to their share of the profits, the additional amount necessary to pay the liabilities of their defaulting partners.

In the event of insolvency, a court may take possession of both partnership property and individual assets of the partners; this again is a big disadvantage to the partnership form.

The estate of a deceased partner is credited or liable as that partner would have been if she were living at the time of the distribution.

KEY TAKEAWAY

Under UPA, the withdrawal of any partner from the partnership causes dissolution; the withdrawal may be caused in accordance with the agreement, in violation of the agreement, by operation of law, or by court order. Dissolution terminates the partners’ authority to act for the partnership, except for winding up, but remaining partners may decide to carry on as a new partnership or may decide to terminate the firm. If they continue, the old creditors remain as creditors of the new firm, the former partner remains liable for obligations incurred while she was a partner (she may be liable for debts arising after she left, unless proper notice is given to creditors), and the former partner or her estate is entitled to an accounting and payment for the partnership interest. If the partners move to terminate the firm, winding up begins.

Under RUPA, a partner who ceases to be involved in the business is dissociated, but dissociation does not necessarily cause dissolution. Dissociation happens when a partner quits, voluntarily or involuntarily; when a partner dies or becomes incompetent; or on request by the firm or a partner upon court order for a partner’s wrongful conduct, among other reasons. The dissociated partner loses actual authority to bind the firm but remains liable for predissociation obligations and may have lingering authority or lingering liability for two years provided the other party thought the dissociated one was still a partner; a notice of dissociation will, after ninety days, be good against the world as to dissociation and dissolution. If the firm proceeds to termination (though partners can stop the process before its end), the next step is dissolution, which occurs by acts of partners, by operation of law, or by court order upon application by a partner if continuing the business has become untenable. After dissolution, the only business undertaken is to wind up affairs. However, the firm may continue after dissociation; it must buy out the dissociated one’s interest, minus damages if the dissociation was wrongful.

If the firm is to be terminated, winding up entails finishing the business at hand, paying off creditors, and splitting the remaining surplus or liabilities according the parties’ agreement or, absent any, according to the relevant act (UPA or RUPA).

EXERCISES

- Under UPA, what is the effect on the partnership of a partner’s ceasing to be involved in the business?

- Can a person no longer a partner be held liable for partnership obligations after her withdrawal? Can such a person incur liability to the partnership?

- What obligation does a partnership or its partners owe to a partner who wrongfully terminates the partnership agreement?

- What bearing does RUPA’s use of the term dissociatehave on the entity theory that informs the revised act?

- When a partnership is wound up, who gets paid first from its assets? If the firm winds up toward termination and has inadequate assets to pay its creditors, what recourse, if any, do the creditors have?

- 3037 reads