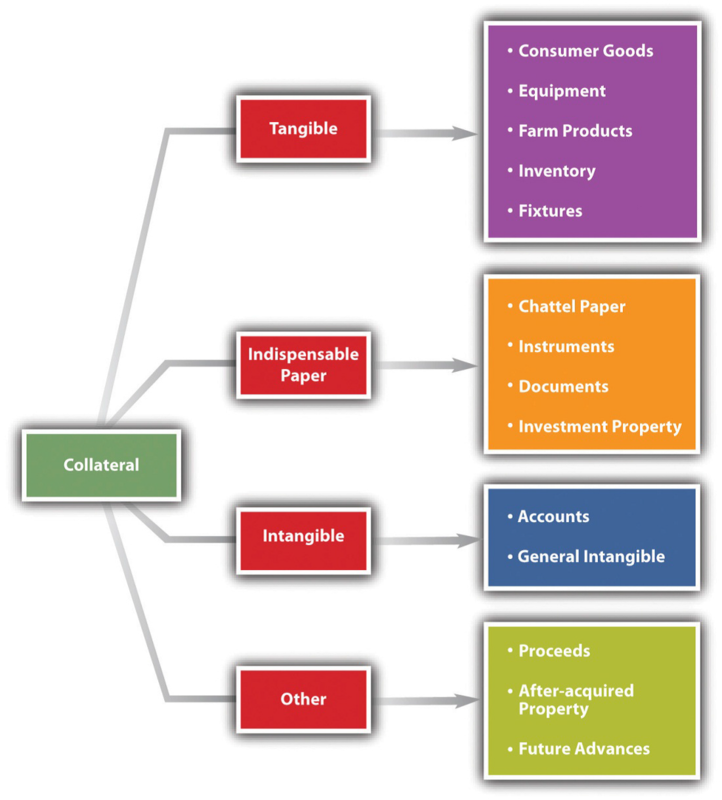

Among possible other types of collateral that may be used as security is thefloating lien. This is a security interest in property that was not in the possession of the debtor when the security agreement was executed. The floating lien creates an interest that floats on the river of present and future collateral and proceeds held by—most often—the business debtor. It is especially useful in loans to businesses that sell their collateralized inventory. Without the floating lien, the lender would find its collateral steadily depleted as the borrowing business sells its products to its customers. Pretty soon, there’d be no security at all. The floating lien includes the following:

- After-acquired property. This is property that the debtor acquires after the original deal was set up. It allows the secured party to enhance his security as the debtor (obligor) acquires more property subject to collateralization.

- Sale proceeds. These are proceeds from the disposition of the collateral. Carl Creditor takes a secured interest in Deborah Debtor’s sailboat. She sells the boat and buys a garden tractor. The secured interest attaches to the garden tractor.

- Future advances. Here the security agreement calls for the collateral to stand for both present and future advances of credit without any additional paperwork.

Here are examples of future advances:

- Example 1: A debtor enters into a security agreement with a creditor that contains a future advances clause. The agreement gives the creditor a security interest in a $700,000 inventory-picking robot to secure repayment of a loan made to the debtor. The parties contemplate that the debtor will, from time to time, borrow more money, and when the debtor does, the machine will stand as collateral to secure the further indebtedness, without new paperwork.

- Example 2: A debtor signs a security agreement with a bank to buy a car. The security agreement contains a future advances clause. A few years later, the bank sends the debtor a credit card. Two years go by: the car is paid for, but the credit card is in default. The bank seizes the car. “Whoa!” says the debtor. “I paid for the car.” “Yes,” says the bank, “but it was collateral for all future indebtedness you ran up with us. Check out your loan agreement with us and UCC Section 9-204(c), especially Comment 5.”

See Figure 33.2.

- 瀏覽次數:1436