It may consist of the security agreement itself, as long as it contains the information required by the UCC, but most commonly it is much less detailed than the security agreement: it “indicates merely that a person may have a security interest in the collateral[.]…Further inquiry from the parties concerned will be necessary to disclose the full state of affairs.” 1 The financing statement must provide the following information:

- The debtor’s name. Financing statements are indexed under the debtor’s name, so getting that correct is important. Section 9-503 of the UCC describes what is meant by “name of debtor.”

- The secured party’s name.

- An “indication” of what collateral is covered by the financing statement. 2 It may describe the collateral or it may “indicate that the financing statement covers all assets or all personal property” (such generic references are not acceptable in the security agreement but are OK in the financing statement). 3 If the collateral is real-property-related, covering timber to be cut or fixtures, it must include a description of the real property to which the collateral is related. 4

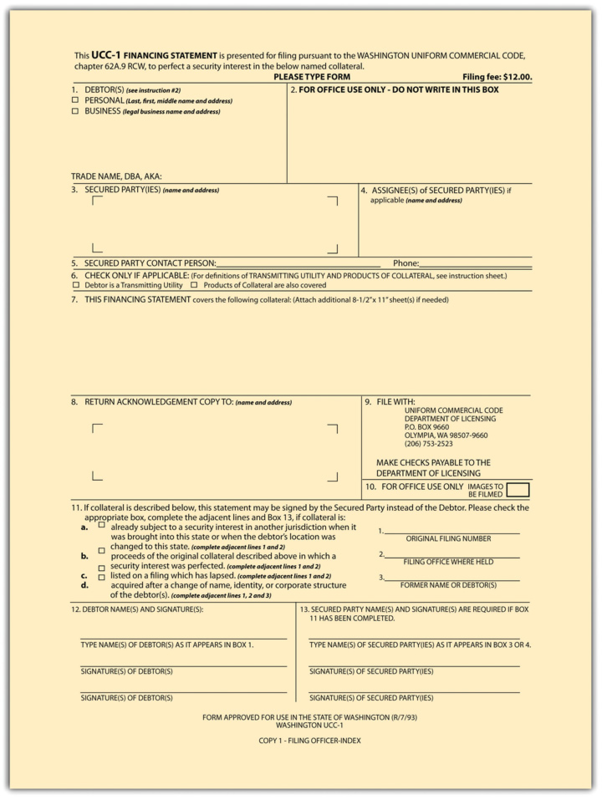

The form of the financing statement may vary from state to state, but see Figure 33.3 for a typical financing statement. Minor errors or omissions on the form will not make it ineffective, but the debtor’s signature is required unless the creditor is authorized by the debtor to make the filing without a signature, which facilitates paperless filing. 5

- 瀏覽次數:1150