The foreign exchange market is the most liquid financial market in the world. Traders include large banks, central banks, institutional investors, currency speculators, corporations, governments, other financial institutions, and retail investors. The average daily turnover in the global foreign exchange and related markets is continuously growing. According to the 2010 Triennial Central Bank Survey, coordinated by the Bank for International Settlements, average daily turnover was US$3.98 trillion in April 2010 (vs $1.7 trillion in 1998) 1. Of this $3.98 trillion, $1.5 trillion was spot transactions and $2.5 trillion was traded in outright forwards, swaps and other derivatives.

Trading in the United Kingdom accounted for 36.7% of the total, making it by far the most important centre for foreign exchange trading. Trading in the United States accounted for 17.9%, and Japan accounted for 6.2% 2.

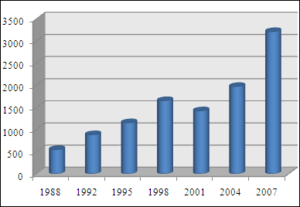

Turnover of exchange-traded foreign exchange futures and options have grown rapidly in recent years, reaching $166 billion in April 2010 (double the turnover recorded in April 2007). Exchange-traded currency derivatives represent 4% of OTC foreign exchange turnover. Foreign exchange futures contracts were introduced in 1972 at the Chicago Mercantile Exchange and are actively traded relative to most other futures contracts.

Most developed countries permit the trading of derivative products (like futures and options on futures) on their exchanges. All these developed countries already have fully convertible capital accounts. Some governments of emerging economies do not allow foreign exchange derivative products on their exchanges because they have capital controls. The use of derivatives is growing in many emerging economies 3. Countries such as Korea, South Africa, and India have established currency futures exchanges, despite having some capital controls.

Top 10 currency traders 4

% of overall volume, May 2012

| Rank | Name | Market share |

|---|---|---|

| 1 | Deutsche Bank | 14.57% |

| 2 | Citi | 12.26% |

| 3 | Barclays Investment Bank | 10.95% |

| 4 | UBS AG | 10.48% |

| 5 | HSBC | 6.72% |

| 6 | JPMorgan | 6.6% |

| 7 | Royal Bank of Scotland | 5.86% |

| 8 | Credit Suisse | 4.68% |

| 9 | Morgan Stanley | 3.52% |

| 10 | Goldman Sachs | 3.12% |

Foreign exchange trading increased by 20% between April 2007 and April 2010 and has more than doubled since 2004 5. The increase in turnover is due to a number of factors: the growing importance of foreign exchange as an asset class, the increased trading activity of high-frequency traders, and the emergence of retail investors as an important market segment. The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. By 2010, retail trading is estimated to account for up to 10% of spot turnover, or $150 billion per day (see retail foreign exchange platform).

Foreign exchange is an over-the-counter market where brokers/dealers negotiate directly with one another, so there is no central exchange or clearing house. The biggest geographic trading center is the United Kingdom, primarily London, which according to TheCityUK estimates has increased its share of global turnover in traditional transactions from 34.6% in April 2007 to 36.7% in April 2010. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day.

- 瀏覽次數:2029