Every purchase incorporates an element of risk, and basic finance proclaims that risk and return are directly related. Thus, consumers may be willing to pay a higher price if they can lower the risk of their transaction.

Consider the case of auto dealers who can either buy a used car at an auto auction or purchase on-line via the Web. With on-line buying, it is possible for dealers to reduce their risk. Dealers can treat the on-line system as part of their inventory and sell cars off this virtual lot. The dealer can buy cars as needed to meet customer demand. In the best case scenario, a buyer requests a particular model, the dealer checks the Web site, puts a hold on a particular car, negotiates the price with the buyer, and then buys the car from the Web. In effect, the dealer sells the car before buying it. In this case, the dealer avoids the risks associated with buying a car in anticipation of finding a customer.

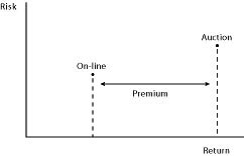

Dealers can be expected to pay a premium when the risk of the transaction is reduced. As Figure 8.2 illustrates, some dealers may perceive buying a car at an auction as higher risk, and thus expect a higher return compared to buying on-line. The difference in the return is the premium that a dealer will be willing to pay for a car purchased on-line, all other things being equal.

Web-based merchants who can reduce the buyer's risk should be able to command a higher price for their product. Typical methods for reducing risk include higher quality and more timely information, and reducing the length of the buy and resell cycle. This risk effect that we describe should be equally applicable to both organizational buyers and individual consumers. Again, the Web creates a special opportunity for sellers to reduce the risks that buyers face. In turn, sellers can charge a higher price to buyers for this benefit (risk reduction), which has been created on-line.

- 瀏覽次數:3391