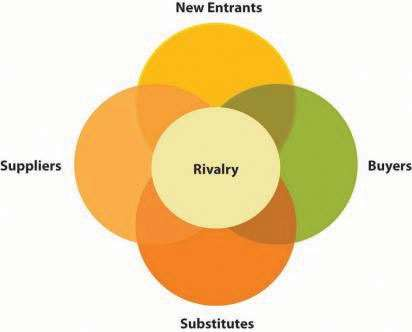

Visit the executive suite of any company and the chances are very high that the chief executive officer and her vice presidents are relying on five forces analysis to understand their industry. Introduced more than thirty years ago by Professor Michael Porter of the Harvard Business School, five forces analysis has long been and remains perhaps the most popular analytical tool in the business world ("Industry Analysis" [Image missing in original]).

The purpose of five forces analysis is to identify how much profit potential exists in an industry. To do so, five forces analysis considers the interactions among the competitors in an industry, potential new entrants to the industry, substitutes for the industry’s offerings, suppliers to the industry, and the industry’s buyers. 1 If none of these five forces works to undermine profits in the industry, then the profit potential is very strong. If all the forces work to undermine profits, then the profit potential is very weak. Most industries lie somewhere in between these extremes. This could involve, for example, all five forces providing firms with modest help or two forces encouraging profits while the other three undermine profits. Once executives determine how much profit potential exists in an industry, they can then decide what strategic moves to make to be successful. If the situation looks bleak, for example, one possible move is to exit the industry.

- 7972 reads