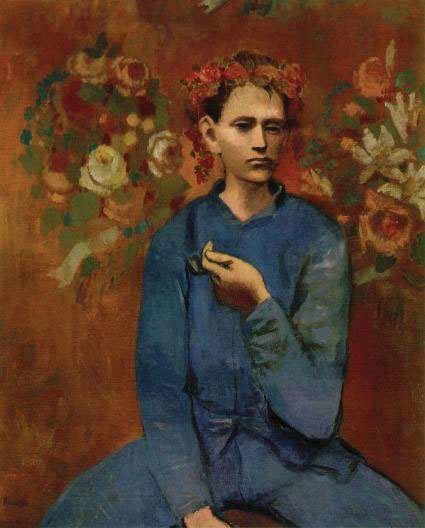

One of the most visible roles of boards of directors is setting CEO pay. The valuation of the human capital associated with the rare talent possessed by some CEOs can be illustrated in a story of an encounter one tourist had with the legendary artist Pablo Picasso. As the story goes, Picasso was once spotted by a woman sketching. Overwhelmed with excitement at the serendipitous meeting, the tourist offered Picasso fair market value if he would render a quick sketch of her image. After completing his commission, she was shocked when he asked for five thousand francs, responding, “But it only took you a few minutes.” Undeterred, Picasso retorted, “No, it took me all my life.” 1

This story illustrates the complexity associated with managing CEO compensation. On the one hand, large corporations must pay competitive wages for the scarce talent that is needed to manage billion-dollar corporations. In addition, like celebrities and sport stars, CEO pay is much more than a function of a day’s work for a day’s pay. CEO compensation is a function of the competitive wages that other corporations would offer for a potential CEO’s services.

On the other hand, boards will face considerable scrutiny from investors if CEO pay is out of line with industry norms. From the year 1980 to 2000, the gap between CEO pay and worker pay grew from 42 to 1 to 475 to 1. 2Although efforts to close this gap have been made, as recently as 2008 reports indicate the ratio continues to be as high as 344 to 1, much higher than other countries, where an 80 to 1 ratio is common, or in Japan where the gap is just 16 to 1. 3. Meanwhile, shareholders need to be aware that research studies have found that CEO pay is positively correlated with the size of firms—the bigger the firm, the higher the CEO’s compensation. 4Consequently, when a CEO tries to grow a company, such as by acquiring a rival firm, shareholders should question whether such growth is in the company’s best interest or whether it is simply an effort by the CEO to get a pay raise.

In most publicly traded firms, CEO compensation generally includes guaranteed salary, cash bonus, and stock options. But perks provide another valuable source of CEO compensation ("CEO Perks" [Image missing in original]). In addition to the controversy surrounding CEO pay, such perks associated with holding the position of CEO have also come under considerable scrutiny. The term perks, derived from perquisite, refers to special privileges, or rights, as a function of one’s position. CEO perks have ranged in magnitude from the sweet benefit of ice cream for life given to former Ben & Jerry’s CEO Robert Holland, to much more extreme benefits that raise the ears of investors while outraging employees. One such perk was provided to John Thain, who, as former head of NYSE Euronext, received more than $1 million to renovate his office. While such perks may provide powerful incentives to stay with a company, they may result in considerable negative press and serve only to motivate vigilant investors wary of the value of such investments to shop elsewhere.

- 2693 reads