Nobel Prize winner in economics, Ronald Coase made a discovery about market behavior that he published in a 1937 article entitled "The Nature of the Firm"5. Coase introduced the notion of “transaction costs” - a set of inefficiencies in the market that add or should be added to the price of a good or service in order to measure the performance of the market relative to the non-market behavior in firms. They include the costs of searching, contracting, and enforcing. Transaction cost economics gives us a way of explaining which activities a firm will choose to perform within its own hierarchy, and which it will rely on the market to perform for it. One important application of transaction costs economics has been as a useful way to explain the outsourcing decisions that many firms face - for example, whether the firm should do its own cleaning, catering or security, or pay someone else to do this.

The effect of communication technology on the size of firms in the past has been to make them larger. Communication technologies permits transaction costs to be lowered to the extent that firms are capable of subsuming many activities within themselves, and thus are able to operate as larger entities even across continents. This has permitted multi-nationals such as General Motors, Sony and Unilever to operate as global enterprises, essentially managed from a head office in Detroit, Tokyo or London, or wherever. Communication technology such as telephones, facsimile machines and telex machines enabled these operators to communicate as easily between Detroit and Sydney as between Detroit and Chicago. Smaller firms found this more difficult and more expensive. So, large firms brought more activities within the firm (or the “hierarchy” in transaction cost terms), for it was cheaper to do this than to rely on the market.

What strategic planners will overlook at their peril in the age of the Internet is that these same communication capabilities are now in the hands of individuals, who can pass messages round the world at as low a cost as the biggest players – essentially, for free. Free voice-over-internet protocol services such as Skype allow individuals to talk for free, regardless of location or distance. They can also hold multi-user conferences, including live video, for free, and simultaneously transmit documents and images. The effect of the new communication technologies, accelerated by Moore’s Law and Metcalfe’s Law will be to reduce the costs of the hierarchy. But more especially, they will reduce the costs of the market itself. As the market becomes more efficient the size of firms might be considerably reduced. More pertinently, as the costs of communication in the market approach zero, so does the size of a firm, which can now rely on the market for most of the activities and functions that need to be performed. A very thorny strategic issue indeed!

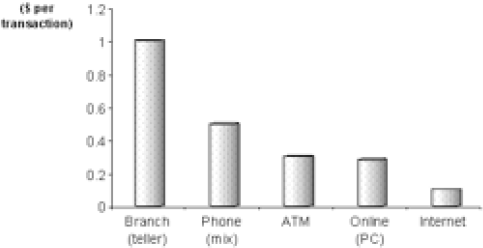

A simple illustration of the effects of transaction cost reductions in an industry is shown in Figure 10.4. When banking is done across the counter with a teller, the average cost per transaction exceeds a dollar; when the same transaction is conducted online the costs reduce to nominal cents. Yet most banks charge their customers more for online banking! One wonders how long they will continue to do this, and how long customers will tolerate it? Already, alternative services are beginning to emerge, that may prove more appealing to many customers.

There are many strategic questions that Coasian economics prompts in the age of the Internet. However, what should undoubtedly top the agendas of many strategic planners in this regard is the issue of what functions the Internet will permit them to outsource. Allied to this is the matter of responding to competitors who do not carry the burden of infrastructure normally borne by traditional firms, having relied on technology to effectively outsource infrastructure and functions to the market.

- 2816 reads