When international transfers of capital began to take the form of direct investment rather than portfolio investment, explanatory theories based on capital movements became inadequate. MNC investment is too complicated a process to be satisfactorily explained via the traditional capital movements theories.

There are three main categories of academic theories concerning the MNC decision to invest: financial theories, life cycle theories, and market imperfection theories. 1

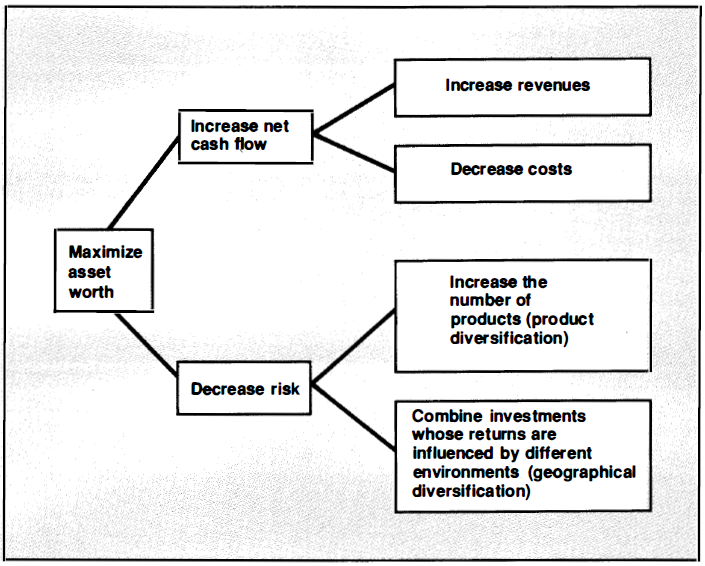

Financial Theories. Financial theories of international investment are more or less straightforward extensions of the financial theories that are used to justify domestic investment. The basic principle that governs domestic investment decisions is the maximization of the worth of an asset. The worth of an asset is equal to the present value of all future cash flows associated with that asset, discounted at a rate that reflects the riskiness of such flows. A company can maximize the worth of an asset by either increasing the net cash flows (increasing revenues or decreasing costs) or decreasing risk (increasing product and area diversification) (see Figure 3.1). According to financial theories, international investment constitutes an attempt to decrease risk by combining investments whose future cash flow returns (revenues) are influenced by different environmental factors such as social, technological, ecological, political, and economic trends.

Life Cycle Theories. Unlike the financial theories, product life cycle theories focus on direct foreign investment. These theories consider such investment to be a bona fide management strategy aimed at overcoming market saturation and/or product maturation (a product's loss of market and customer appeal).

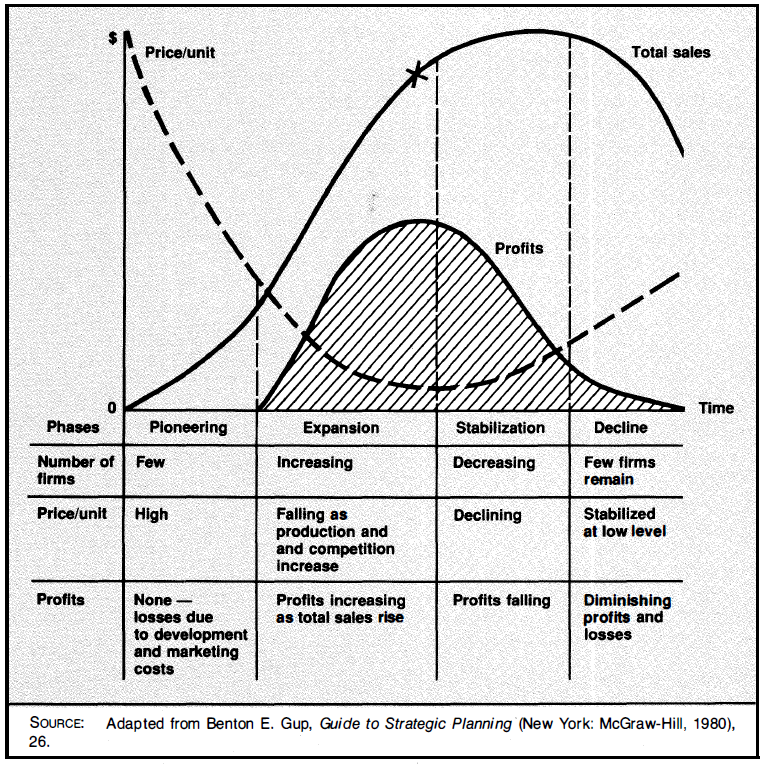

Figure 3.2 depicts a typical product development process. A product goes through four phases of development: 2

- Pioneering/introduction characterized by

- high but declining price/unit ratio

- exponential increase in sales

- substantial losses (absence of profits)

- Expansion/growth characterized by

- smooth decline in the price/unit ratio

- smooth increase in sales

- profits (absence of losses)

- Stabilization/maturation characterized by

- slightly increasing price/unit ratio

- leveling increase in sales

- declining profits

- Decline characterized by

- increasing price/unit ratio

- decreasing sales

- declining profits

Firms exploit the local/domestic market during the pioneering phase, when high prices enable them to recover all development costs. Internationalization begins during the expansion phase (about where the X appears on the sales curve in Figure 3.2), when the presence of profits enables firms to inch their way into the world market. This is the stage of exporting via either an export agent or a small sales office. Slightly before the stabilization phase begins, the firm starts thinking about contractual agreements (such as licensing) and even direct investment. Finally, at the onset of the decline phase, the firm will have transferred most if not all of the productive capacity to a developing country for servicing of the international and to some extent its own domestic market.

Market Imperfection Theories. Market imperfection theories of the transfer of international investment focus on the firm as a whole rather than on a specific product.

Proponents of the Monopolistic Advantage Theory point out that a firm, in the course of its evolution in the home market, acquires certain capabilities and captures a rather substantial market share. The firm then uses these capabilities to secure a leading position in the industry. This position enables the firm to produce and market certain products swiftly, thus depriving other firms of the opportunity to enter the market; to control the availability of existing raw material or the development of new substitutes; and to attract and retain superior managerial and employee talent in production, finance, and marketing. The Monopolistic Advantage Theory states that once the firm has established itself in the home market, it can further exploit the same monopolistic or oligopolistic advantage by reaching out into the world market. This way, production advantages that are due to superior R&D or product and process technology can be prolonged, bringing additional revenues into the company.

The Internalization Theory asserts that external markets (that is, other firms that use the firm's product either as an intermediate or as a final product) are not very efficient. 3 Thus, it is difficult for an unaffiliated firm to recover its developmental and marketing costs and eventually reap a fair return on its investment. For this reason, the firm creates its own market by developing a network of subsidiaries that buy and sell to each other, thereby minimizing transaction costs (the costs associated with handling and processing orders). In addition, these intrafirm transactions between an MNC and its worldwide subsidiaries and among MNC subsidiaries are easier to administer, because market identification and servicing is performed by local firms which act as "members of the same family" rather than true competitors.

Another advantage of internalization is that it provides a safe and sure way of maintaining control of certain knowledge-intensive or high-technology products and processes. The idea here is that in selling via the open market, as opposed to a captive market, a firm risks unfair use of its hard-earned technological advantage by firms that use the product or the process. Most high technology firms in the electronic and pharmaceutical industries make considerable use of internalization as a strategy for "going international."

- 2332 reads