Performance Overview

Net profit before tax to net sales (adj ; %)

Total asset turnover (adj; X)

Net profit before tax to total assets (adj ; %)

Total assets to net worth (adj ; 0/0)

Net profit before tax to net worth (adj ; %)

Operating profit to total assets (adj ; %)

Sales Performance

Dollars of net sales ($000) Percent sales change over prior year (%)

Profitability Performance

Gross margin to net sales (adj ; %)

Operating Expense Control

Total operating expense % of net sales

Total operating expense to gross margin (adj; 0/0)

Non-people expense to gross margin (adj; 0/0)

Total compensation as % of gross margin (adj; %)

Functional Area Expense Control

Selling expense as % of net sales

Delivery expense as % of net sales

Warehouse & occupancy expense as % of net sales

General and administrative expense as % of net sales

Personnel Productivity

Net sales volume per person ($000)

Net sales volume per outside salesperson ($000)

Gross margin per person (adj; $000)

Average compensation per employee ($000)

Personnel productivity index (all emp; adj; X)

Inventory Management Performance

Average inventory turnover rate (X; adj)

Turnover and earning profitability index (adj; %)

Accounts Receivable Management

Days sales in accounts receivable (days)

Financial Management Performance

Net worth to total indebtedness (adj; %)

Current ratio (current assets/current liabilities) (X)

Accounts receivable to accounts·payable (X)

SOURCE: Management Foresight, Inc., Columbus, Ohio.

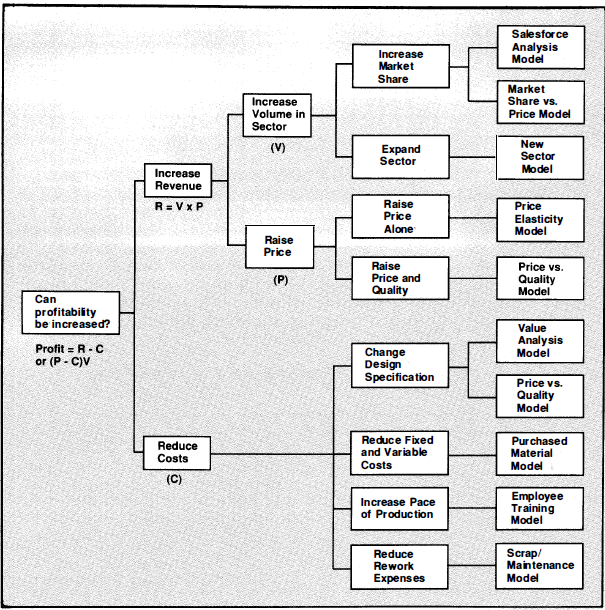

Most companies use some variation of the basic profitability model depicted in Figure 16.2 as the framework for selecting the appropriate control objects for each MNC subsidiary and for the company as a whole. The following generalizations can be made about MNC control systems:

(1) The nature of the system used to control the foreign operations is generally similar to that used to control the company's domestic operations.

Statistical controls and standards developed for appraising domestic operations are generally imposed on foreign subsidiaries.

(2) There is a heavy emphasis on budgeting and financial controls.

(3) There is a tendency to treat foreign subsidiaries as profit centers and to use profits and return-on-investment as criteria for evaluating their performance.

(4) Top management at the headquarters is far more involved in the control of foreign operations than it is in the control of domestic operations. 1

- 2292 reads