They produce a commodity that is essential to our daily lives, one for which the demand is virtually assured. And yet many—even as farm prices are reaching record highs—seem to live on the margin of failure. Thousands are driven out of business each year. We provide billions of dollars in aid for them, but still we hear of the hardships many of them face. They are our nation’s farmers.

What is it about farmers, and farming, that arouses our concern? Much of the answer probably lies in our sense that farming is fundamental to the American way of life. Our country was built, in large part, by independent men and women who made their living from the soil. Many of us perceive their plight as our plight. But part of the answer lies in the fact that farmers do, in fact, face a difficult economic environment. Most of them operate in highly competitive markets, markets that tolerate few mistakes and generally offer small rewards. Finally, perhaps our concern is stirred by our recognition that the farmers’ plight is our blessing. The low prices that make life difficult for farmers are the low prices we enjoy as consumers of food.

What keeps the returns to farming as low as they are? What holds many farmers in a situation in which they always seem to be just getting by? In this chapter we shall see that prices just high enough to induce firms to continue to produce are precisely what we would expect to prevail in a competitive market. We will examine a model of how competitive markets work. Not only does this model help to explain the situation facing farmers, but it will also help us to understand the determination of price and output in a wide range of markets. A farm is a firm, and our analysis of such a firm in a competitive market will give us the tools to analyze the choices of all firms operating in competitive markets.

We will put the concepts of marginal cost, average variable cost, and average total cost to work to see how firms in a competitive market respond to market forces. We will see how firms adjust to changes in demand and supply in the short run and in the long run. In all of this, we will be examining how firms use the marginal decision rule.

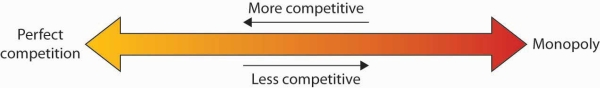

The competitive model introduced in this chapter lies at one end of a spectrum of market models. At the other end is the monopoly model. It assumes a market in which there is no competition, a market in which only a single firm operates. Two models that fall between the extremes of perfect competition and monopoly are monopolistic competition and oligopoly.

- 瀏覽次數:2363