Summary

This chapter examined the world of imperfect competition that exists between the idealized extremes of perfect competition and monopoly. Imperfectly competitive markets exist whenever there is more than one seller in a market and at least one seller has some degree of control over price.

We discussed two general types of imperfectly competitive markets: monopolistic competition and oligopoly. Monopolistic competition is characterized by many firms producing similar but differentiated goods and services in a market with easy entry and exit. Oligopoly is characterized by relatively few firms producing either standardized or differentiated products. There may be substantial barriers to entry and exit.

In the short run, a monopolistically competitive firm’s pricing and output decisions are the same as those of a monopoly. In the long run, economic profits will be whittled away by the entry of new firms and new products that increase the number of close substitutes. An industry dominated by a few firms is an oligopoly. Each oligopolist is aware of its interdependence with other firms in the industry and is constantly aware of the behavior of its rivals. Oligopolists engage in strateg ic decision making in order to determine their best output and pricing strategies as well as the best forms of nonprice competition.

Advertising in imperfectly competitive markets can increase the degree of competitiveness by encouraging price competition and promoting entry. It can also decrease competition by establishing brand loyalty and thus creating barriers to entry.

Where conditions permit, a firm can increase its profits by price discrimination, charging different prices to customers with different elasticities of demand. To practice price discrimination, a price-setting firm must be able to segment customers that have different elasticities of demand and must be able to prevent resale among its customers.

CONCEPT PROBLEMS

- What are the major distinctions between a monopolistically competitive industry and an oligopolistic industry?

- What is the difference between a price taker and a price setter? Which do you think a firm would prefer to be? Why?

- In the model of monopolistic competition, we say that there is product differentiation. What does this mean, and how does it differ from the assumption of homogeneous goods in perfect competition?

- In the following list of goods and services, determine whether the item is produced under conditions of monopolistic competition or of oligopoly.

- soft drinks

- exercise drinks

- office supply stores

- massage therapists

- accountants

- colleges and universities

- astrologists

- Suppose a city experiences substantial population growth. What is likely to happen to profits in the short run and in the long run in the market for haircuts, a monopolistically competitive market?

- Some professors grade students on the basis of an absolute percentage of the highest score earned on each test given during the semester. All students who get within a certain percentage of the highest score earned get an A. Why do these professors not worry that the students will get together and collude in such a way as to keep the high score in the class equal to a very low total?

- Your parents probably told you to avoid tit-for-tat behavior. Why does it make sense for firms to do it?

- What model of oligopoly behavior were the DRAM producers discussed in the Case in Point following? How might the DRAM producers have achieved their goal and still stayed within the law?

- Explain why a price increase for foreigners would increase Costa Rica’s total revenue and profits from operating its national park system.

- Restaurants typically charge much higher prices for dinner than for lunch, despite the fact that the cost of serving these meals is about the same. Why do you think this is the case? (Hint: Think about the primary consumers of these meals and their respective elasticities.)

- What effect do you think advertising to discourage cigarette smoking will have on teens? On adults? What changes might occur in the cigarette market as a result?

- Many manufacturers of clothing and other consumer goods open stores in outlet malls where they charge much lower prices than they charge in their own stores located within cities. Outlet malls are typically located a considerable distance from major metropolitan areas, and stores in them typically charge much lower prices than do stores located within cities. Given that both sets of stores are often owned by the same firm, explain this price discrimination based on likely differences in the price elasticity of demand between consumers in the two types of stores.

- Suppose a particular state were to ban the advertising of prices charged by firms that provide laser eye surgery. What effect do you think that would have on the price of this service?

- The Case in Point on microbreweries noted that a large number of such breweries open every year. Yet, the model of monopolistic competition predicts that the long run equilibrium solution in such markets is one of zero economic profits. Why do firms enter such industries?

- Many lawyers advertise their services. Do you think this raises or lowers the price of legal services? Explain your answer carefully.

NUMERICAL PROBLEMS

- Suppose the monopolistically competitive barber shop industry in a community is in long-run equilibrium, and that the typical price is $20 per haircut. Moreover, the population is rising.

- Illustrate the short-run effects of a change on the price and output of a typical firm in the market.

- Show what happens in the long run. Will the final price be higher than $20? Equal $20? Be less than $20? Assume that nothing happens to the cost of producing haircuts.

- Suppose that, initially, the price of a typical children’s haircut is $10. Do you think this represents price discrimination? Why or why not?

- Consider the same industry as in Problem 1. Suppose the market is in long-run equilibrium and that an annual license fee is imposed on barber shops.

- Illustrate the short-run effects of the change on the price and output of haircuts for a typical firm in the community.

- Now show what happens to price and output for a typical firm in the long run.

- Who pays the fee in the long run? How does this compare to the conclusions of the model of perfect competition?

- Industry A consists of four firms, each of which has an equal share of the market.

- Compute the Herfindahl-Hirschman index for the industry.

- Industry B consists of 10 firms, each of which has an equal share of the market. Compare the Herfindahl–Hirschman Indexes for the two industries.

- Now suppose that there are 100 firms in the industry, each with equal shares. What is the Herfindahl-Hirschman index for this industry?

- State the general relationship between the competitiveness of an industry and its Herfindahl-Hirschman index.

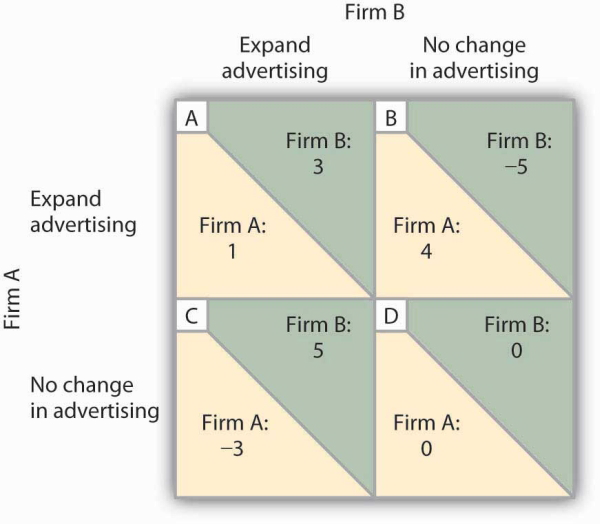

- Given the payoff matrix (shown below) for a duopoly, consisting of Firm A and Firm B, in which each firm is considering an expanded advertising campaign, answer the following questions

(all figures in the payoff matrix give changes in annual profits in millions of dollars):

- Does Firm A have a dominant strategy?

- Does Firm B have a dominant strategy?

- Is there a dominant strategy equilibrium? Explain.

Figure 11.6

Figure 11.6

- Suppose that two industries each have a four-firm concentration ratio of 75%.

- Explain what this means.

- Suppose that the HHI of the first industry is 425, and that the HHI of the second is 260. Which would you say is the more competitive? Why?

- Suppose that a typical firm in a monopolistically competitive industry faces a demand curve given by:

q = 60 − (1/2)p, where q is quantity sold per week. The firm’s marginal cost curve is given by: MC = 60.

- How much will the firm produce in the short run?

- What price will it charge?

- Draw the firm’s demand, marginal revenue, and marginal cost curves. Does this solution represent a long-run equilibrium? Why or why not?

- 瀏覽次數:4138