Concern that regulation might sometimes fail to serve the public interest prompted a push to deregulate some industries, beginning in the late 1970s. In 1978, for example, Congress passed the Airline Deregulation Act, which removed many of the regulations that had prevented competition in the airline industry. Safety regulations were not affected. The results of deregulation included a substantial reduction in airfares, the merger and consolidation of airlines, and the emergence of frequent flier plans and other marketing schemes designed to increase passenger miles. Not all the consequences of deregulation were applauded, however. Many airlines, unused to the demands of a competitive, unprotected, and unregulated environment, went bankrupt or were taken over by other airlines. Large airlines abandoned service to small and midsized cities, and although most of these routes were picked up by smaller regional airlines, some consumers complained about inadequate service. Nevertheless, the more competitive airline system today is probably an improvement over the highly regulated industry that existed in the 1970s. It is certainly cheaper. Table 16.3 suggests that the improvements in consumer welfare from deregulation through the 1990s have been quite substantial across a broad spectrum of industries that have been deregulated.

|

Industry |

Improvements |

|

Airlines |

Average fares are roughly 33% lower in real terms since deregulation, and service frequently has improved significantly. |

|

Less-than-truckload trucking |

Average rates per vehicle mile have declined at least 35% in real terms since deregulation, and service times have improved significantly. |

|

Truckload trucking |

Average rates per vehicle mile have declined by at least 75% in real terms since deregulation, and service times have improved significantly. |

|

Railroads |

Average rates per ton-mile have declined more than 50% in real terms since deregulation, and average transit time has fallen more than 20%. |

|

Banking |

Consumers have benefited from higher interest rates on deposits, from better opportunities to manage risk, and from more banking offices and automated teller machines. |

|

Natural gas |

Average prices for residential customers have declined at least 30% in real terms since deregulation, and average prices for commercial and industrial customers have declined more than 30%. In addition, service has been more reliable as shortages have been almost completely eliminated. |

Economist Clifford Winston found substantial benefits from deregulation in the five industries he studied—airlines, trucking, railroads, banking, and natural gas.

Source: Clifford Winston, “U.S. Industry Adjustment to Economic Deregulation,” Journal of Economic Perspectives 12(3) (Summer 1998): 89–110.

But there are forces working in the opposite direction as well. Many businesses continue to turn to the government for protection from competition. Public choice theory suggests that more, not less, regulation is often demanded by firms threatened with competition at home and abroad. More and more people seem to demand environmental protection, including clear air, clean water, and regulation of hazardous waste and toxic waste. Indeed, as incomes rise over time, there is evidence that the demand for safety rises. This market phenomenon began before the birth of regulatory agencies and can be seen in the decline in unintentional injury deaths over the course of the last hundred years. W. Kip Viscusi, “Safety at Any Price?” Regulation, Fall 2002: 54– 63. And there is little reason to expect less demand for regulations in the areas of civil rights, handicapped rights, gay rights, medical care, and elderly care.

The basic test of rationality—that marginal benefits exceed marginal costs—should guide the formulation of regulations. While economists often disagree about which, if any, consumer protection regulations are warranted, they do tend to agree that market incentives ought to be used when appropriate and that the most cost-effective policies should be pursued.

KEY TAKEAWAYS

- Federal, state, and local governments regulate the activities of firms and consumers.

- The public interest theory of regulation asserts that regulatory efforts act to move markets closer to their efficient solutions.

- The public choice theory of regulation argues that regulatory efforts serve private interests, not the public interest.

- Consumer protection efforts may sometimes be useful, but they tend to produce behavioral responses that often negate the effort at protection.

- Deregulation efforts through the 1990s generally produced large gains in consumer welfare, though demand for more regulation is rising in certain areas, especially finance.

TRY IT!

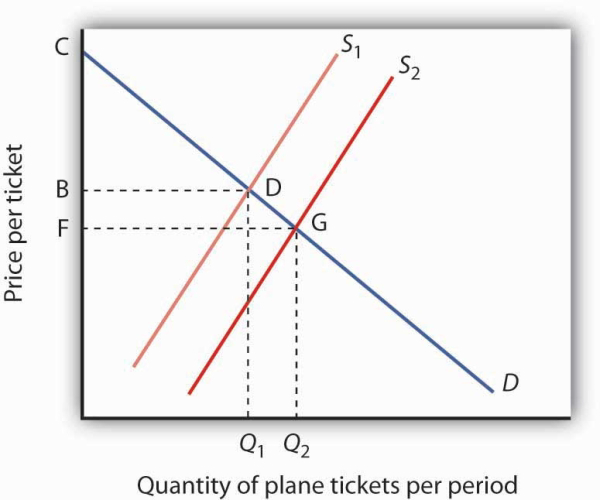

The deregulation of the airline industry has generally led to lower fares and increased quantities produced. Use the model of demand and supply to show this change. What has happened to consumer surplus in the market? (Hint: You may want to refer back to the earlier discussion of consumer surplus.)

Case in Point: Do Consumer Protection Laws Protect Consumers?

Economist W. Kip Viscusi of the Harvard Law School has long advocated economic approaches to health and safety regulations. Economic approaches recognize 1) behavioral responses to technological regulations; 2) performance-oriented standards as opposed to command-and-control regulations; and 3) the opportunity cost of regulations. Below are some examples of how these economic approaches would improve health and safety policy.

Behavioral responses: Consider the requirement, imposed in 1972, that aspirin containers have childproof caps. That technological change seemed straightforward enough. But, according to Mr. Viscusi, the result has not been what regulators expected. Mr. Viscusi points out that childproof caps are more difficult to open. They thus increase the cost of closing the containers properly. An increase in the cost of any activity reduces the quantity demanded. So, childproof caps result in fewer properly closed aspirin containers.

Mr. Viscusi calls the response to childproof caps a “lulling effect.” Parents apparently think of containers as safer and are, as a result, l ess careful with them. Aspirin containers, as well as other drugs with childproof caps, tend to be left open. Mr. Viscusi says that the tragic result is a dramatic increase in the number of children poisoned each year. Hence, he urges government regulators to take behavioral responses into account when promulgating technological solutions. He also advocates well-articulated hazard warnings that give consumers information on which to make their own choices.

Performance-oriented standards: Once a health and safety problem has been identified, the economic approach would be to allow individuals or firms discretion in how to address the problem as opposed to mandating a precise solution. Flexibility allows a standard to be met in a less costly way and can have greater impact than command-and-control approaches. Mr. Viscusi cites empirical evidence that worker fatality rates would be about one-third higher were it not for the financial incentives firms derive from creating a safer workplace and thereby reducing the workers’ compensation premiums they pay. In contrast, empirical estimates of the impact of OSHA regulations, most of which are of the command-and-control type, range from nil to a five to six percent reduction in worker accidents that involve days lost from work.

Opportunity cost of regulations: Mr. Viscusi has estimated the cost per life saved on scores of regulations. Some health and safety standards have fairly low cost per life saved. For example, car seat belts and airplane cabin fire protection cost about $100,000 per life saved. Automobile side impact standards and the children’s sleepwear flammability ban, at about $1 million per life saved, are also fairly inexpensive. In contrast, the asbestos ban costs $131 million per life saved, regulations concerning municipal solid waste landfills cost about $23 billion per life saved, and regulations on Atrazine/alachlor in drinking water cost a whopping $100 billion per life saved. “A regulatory system based on sound economic principles would reallocate resources from the high-cost to the low-cost regulations. That would result in more lives saved at the same cost to society.”

Sources: W. Kip Viscusi, “Safety at Any Price?” Regulation, Fall 2002: 54–63; W. Kip Viscusi, “The Lulling Effect: The Impact of Protective Bottlecaps on Aspirin and Analgesic Poisonings,” American Economic Review 74(2) (1984): 324–27.

ANSWER TO TRY IT! PROBLEM

Deregulation of the airline industry led to sharply reduced fares and expanded output, suggesting that supply increased. That should significantly increase consumer surplus. Specifically, the supply curve shifted from S1 to S2. Consumer surplus is the difference between the total benefit received by consumers and total expenditures by consumers. Before deregulation, when the price was B and the quantity was Q1, the consumer surplus was BCD. The lower rates following deregulation reduced the price to consumers to, say, F, and increased the quantity to Q2 on the graph, thereby increasing consumer surplus to FCG.

- 瀏覽次數:3787