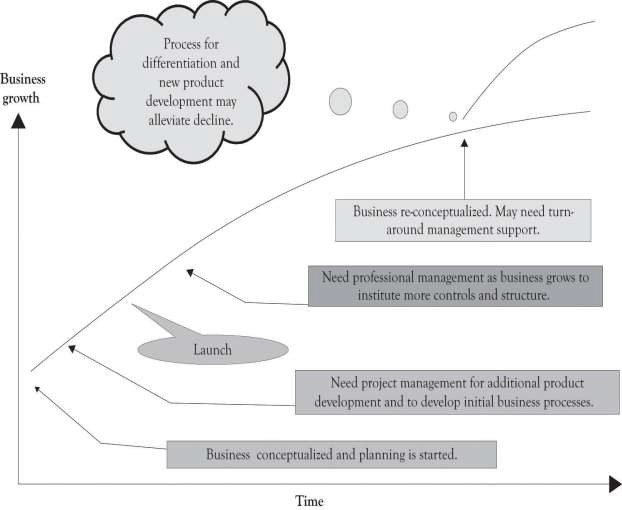

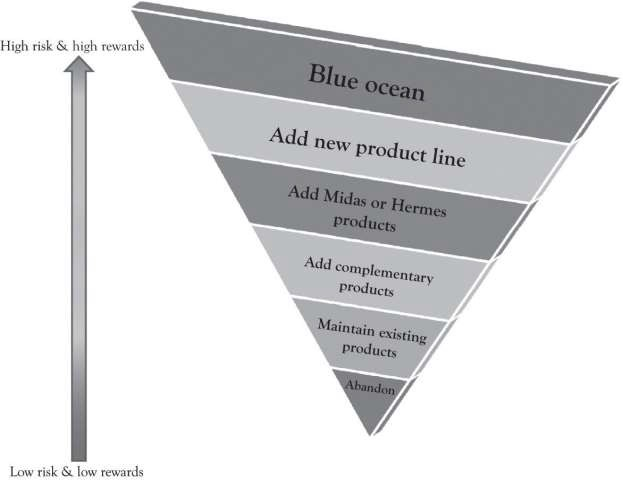

Making the right investment decision on the right projects and the right products at the right time is a combination of having the right information, intuition, and luck. As Figure 14.1 illustrates if there is a process in place for differentiation and new product development, and then the decline of the business may be alleviated. There are choices and decisions to be made related to populating the product and project portfolio. These are the critical investment decisions that the entrepreneur has to make. Figure 14.2 illustrates that the potential profitability is greater as you climb up the inverted pyramid, but there are also greater levels of risk and uncertainty toward the top. All businesses face the following investment decisions while climbing the reward pyramid:

- Maintenance decision: They can maintain their current investment in products, projects, machines, and technologies. This also takes into account investment to deal with depreciation. This is the maintain option. The goal of the maintain strategy is to keep current customers with existing products and services. Learning-about and learn-by-doing are maintained at current levels.

-

Growth decision: They have the option to invest a little or a lot in new products, projects, machines, and

technologies. There is a step-up in learning-about and learning-by-doing. This is the growth option and it includes a number of approaches:

- Differentiate by scaling-up existing product line. Scaling up your investment and investing even more. For example, adding features for Midas customers and acquiring new Hermes customers on the existing demand curve.

- Differentiate by scoping-up and developing complementary products for existing product line.

- Differentiate by scoping-up and developing new products that are not part of the existing demand curve.

- Differentiate by switching-up the growth path. A switching-up decision incorporates both growth and abandonment options. When a company makes a switch-up decision, it may discard previous investments and take a different path for growth based on the capabilities accumulated from the previous investments. It typically concerns a switch of input, output, or location. For example, instead of using technology A, a firm may use technology B to produce the same thing. Instead of using the current machine to produce product X, a firm may produce product Y (cf. flexible manufacturing system). A company can switch among locations for research and development, manufacturing, distribution, and so forth.

- Develop new Blue Ocean market. This involves scaling-up, scoping-up, and switching-up. This can be a substitute product that competes with an existing line.

- Abandon decision: They have the option to abandon investing in new or existing products, projects, machines, and technologies. The abandon strategy relates to the inadequacy of the current business model and the need to bail.

- Postpone decision: They can defer investing in a product or a technology until a later date. Some investment might occur in the form of monitoring and very early exploratory work. The major investment includes learning-about in the form of search and synthesis.

There are three primary approaches for evaluating investment decisions. They are payback, discounted cash flow analysis, and real options analysis. We discussed the discounted cash flow techniques in Project Management for New Products and Services. The focus of this chapter is on real options analysis.

- 瀏覽次數:3692