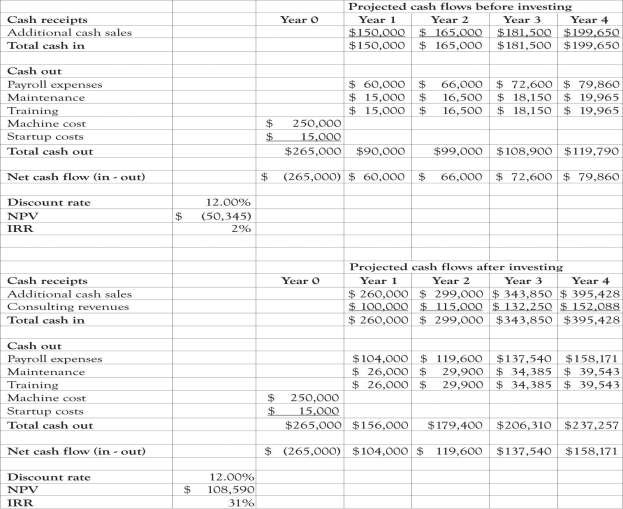

The president of Jin Bean’s assembled a group of financial analysts; the marketing department and the operations department conducted a study to ascertain the cost of switching bottle production in-house. They determined that it would cost the company an additional $1 million per year to purchase the machines, hire staff, and maintain the machines over what they are currently paying to import their bottles. Each machine costs $250,000 and will involve personnel costs and maintenance costs exceeding $100,000. No matter how they put the numbers together, they could not generate a positive NPV. Even though the figures did not look good, the presidents of Jin Bean decided to go ahead and purchase one machine and install it in Florida. The decision of Jin Bean’s president was based on her knowledge of real options analysis. By purchasing and using one machine, they were able to learn and conduct an economic experiment. The company could obtain insight and also acquire the flexibility to expand in the future as the effect of the investment on the bottom-line gets clearer and knowledge about the use of the machine is accumulated. 1

The result of this experiment and installation was enlightening. Jin Bean was able to generate more sales with the new injection molding machine and they were also able to provide external consulting to other businesses and to sell specialized plastic containers at a premium price. Jin Bean also used the injection machine to experiment with new bottle designs and product ingredients. In the past, it would take them a year to introduce a new bottle to the market and several months to understand the sales results. Now they were able to deliver a new product in less than a year. They were able to increase their market share and became very responsive to market demands because of their increased flexibility. The data they were able to gather by experimenting with one machine was then used to conduct an NPV and IRR analysis and resulted in a very attractive return for their investment (see Figure 14.4). Jin Bean subsequently decided to obtain four additional machines because they have the confidence to further pursue a growth option and invest in more injection molding machines.

Many real-world investment decisions are not easily analyzed with NPV and IRR analysis. Investing in a new technology can take the firm down many different paths as the organization learns about and learns by doing and experimenting with new technology and products. If you look at most of the Blue Ocean markets—for example, Cirque du Soleil, social networking services or global positioning system products—they came about as a result of experimentation and the progression of little ahas that turn into the big aha. It is basically a learning and adaptation strategy that is focused on product and process differentiation.

Business conditions are fraught with uncertainty and risks. These uncertainties hold with them valuable information. When uncertainty becomes resolved through the passage of time, actions and events, managers can make the appropriate midcourse corrections through a change in business decisions and strategies. Real options incorporates this learning model, it is akin to having a strategic road map, while traditional analyses that neglect managerial flexibility will grossly undervalue certain projects and strategies. 2

Real options analysis can be very technical, requiring a significant amount of financial and technical scrutiny. However, we believe that using complicated calculations is overkill for small- and medium-sized businesses. Real options concepts are nevertheless important. The takeaway from the perspective of the entrepreneur is that you need to experiment with diversifying your portfolio of products and projects under consideration. This does not mean that you have to actually buy machinery, make products, and constantly modify your business processes, but it does mean that you should learn-about many products and technologies related to your business and learn-by-doing and experimenting when an opportunity looks promising.

There are two important considerations related to real options that companies should consider before making large investment decisions. The first important consideration is how will the investment interact with current investments, and the second important consideration is how will the competition respond to an investment decision. 3

- 瀏覽次數:2831