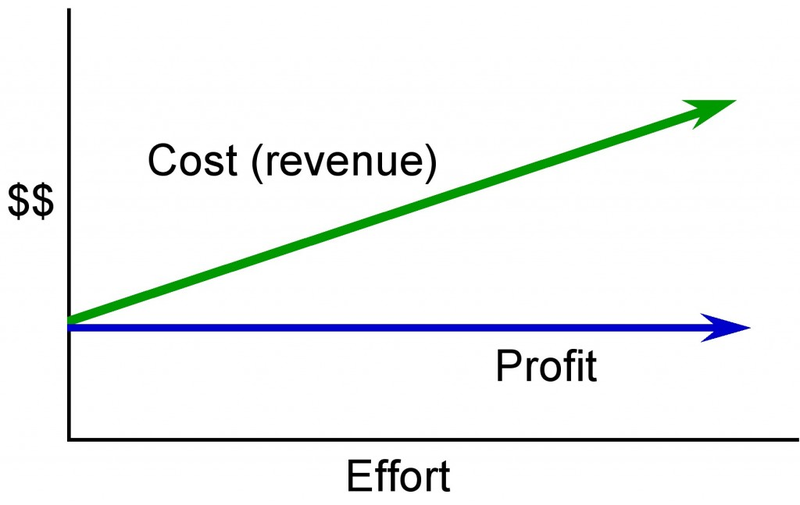

In a cost-reimbursable contract, the organization agrees to pay the contractor for the cost of performing the service or providing the goods. Cost-reimbursable contracts are also known as cost-plus contracts. Cost-reimbursable contracts are most often used when the scope of work or the costs for performing the work are not well known. The project uses a cost-reimbursable contract to pay the contractor for allowable expenses related to performing the work. Since the cost of the project is reimbursable, the contractor has much less risk associated with cost increases. When the costs of the work are not well known, a cost-reimbursable contract reduces the amount of money the bidders place in the bid to account for the risk associated with potential increases in costs. The contractor is also less motivated to find ways to reduce the cost of the project unless there are incentives for supporting the accomplishment of project goals.

Cost-reimbursable contracts require good documentation of the costs that occurred on the project to ensure that the contractor gets paid for all the work performed and to ensure that the organization is not paying for something that was not completed. The contractor is also paid an additional amount above the costs. There are several ways to compensate the contractor.

- A cost-reimbursable contract with a fixed fee provides the contractor with a fee, or profit amount, that is determined at the beginning of the contract and does not change.

- A cost-reimbursable contract with a percentage fee pays the contractor for costs plus a percentage of the costs, such as 5% of total allowable costs. The contractor is reimbursed for allowable costs and is paid a fee.

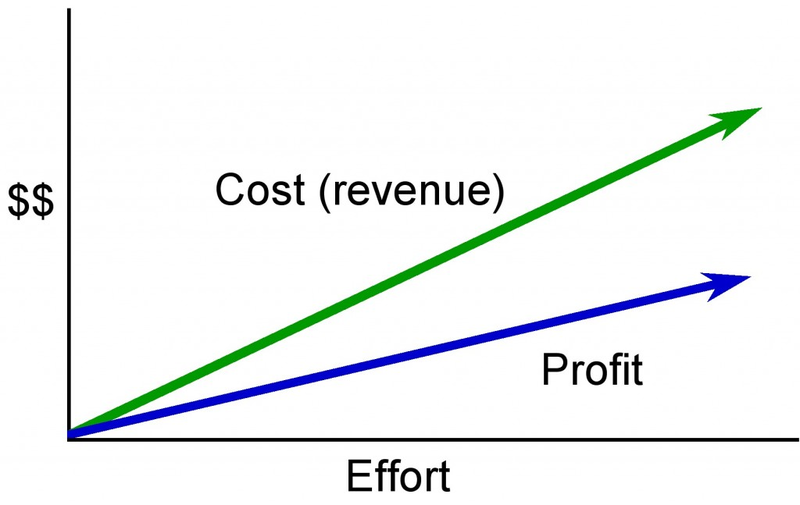

- A cost-reimbursable contract with an incentive fee is used to encourage performance in areas critical to the project. Often the contract attempts to motivate contractors to save or reduce project costs. The use of the cost reimbursable contract with an incentive fee is one way to motivate cost-reduction behaviors.

- A cost-reimbursable contract with award fee reimburses the contractor for all allowable costs plus a fee that is based on performance criteria. The fee is typically based on goals or objectives that are more subjective. An amount of money is set aside for the contractor to earn through excellent performance, and the decision on how much to pay the contractor is left to the judgment of the project team. The amount is sufficient to motivate excellent performance.

On small activities that have a high uncertainty, the contractor might charge an hourly rate for labor, plus the cost of materials, plus a percentage of the total costs. This type of contract is called time and materials (T&M). Time is usually contracted on an hourly rate basis and the contractor usually submits time sheets and receipts for items purchased on the project. The project reimburses the contractor for the time spent based on the agreed-on rate and the actual cost of the materials. The fee is typically a percentage of the total cost.

T&M contracts are used on projects for work that is smaller in scope and has uncertainty or risk. The project, rather than the contractor, assumes the risk. Since the contractor will most likely include contingency in the price of other types of contracts to cover the high risk, T&M contracts provide lower total cost to the project.

To minimize the risk to the project, the contractor typically includes a not-to-exceed amount, which means the contract can only charge up to the agreed amount. The T&M contract allows the project to make adjustments as more information is available. The final cost of the work is not known until sufficient information is available to complete a more accurate estimate.

- 5847 reads