For the purposes of accounting, please forget what you know about credits and debits. In accounting, debit (Dr.) and credit (Cr.) have nothing to do with plastic cards that let you buy stuff. In fact, what most beginning accounting students need to know about Dr/Cr can be boiled down to two sentences.

|

|

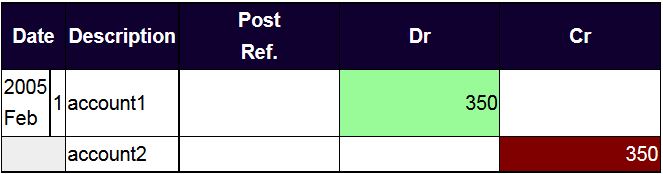

Debit is on the left. Credit is on the right. |

|

How are debit and credit rules applied to different types of accounts? |

|

|

|

DEBIT......NATURE OF A/Cs.......CREDIT |

|

|

Increase.........ASSETS........Decrease |

|

|

Decrease......LIABILITIES......Increase |

|

|

Decrease.........REVENUE.......Increase |

|

|

Decrease.........EQUITY........Increase |

|

|

Increase........EXPENSES.......Decrease |

|

|

Increase........DRAWINGS.......Decrease |

In case of ASSETS and EXPENSES; increases go to the debit side, while decreases go to credit side. On the other hand, in case of LIABILITIES, REVENUE and EQUITY; increases go to the credit side and decreases go to debit side.

An account will have either a "normal credit balance" or a "normal debit balance", depending on the type of account. The normal balance indicates which side of the account the amount goes to when the account balance increases. For example, the account 'Cash' has a normal debit balance: receiving cash results in a debit entry, spending it results in a credit entry.

Debits and credits may be derived from the fundamental accounting equation. They result from the nature of double entry bookkeeping. Two entries are made in each balanced transaction, a debit and a credit. This allows the accounts to be balanced to check for entry or transaction recording errors.

Owner's Equity = Assets - Liabilities is written from the perspective of the owner. In accounting this is generally rewritten from the perspective of the business or commercial entity the books detail:

Assets = Owner's Equity + Liabilities (Fundamental Accounting Equation)

Entries in the books are in pairs and track the advantage or asset of the company simultaneously with the disadvantage or liability. In this view the Owner's equity is a claim of the investor against the company.

- On the left side or Assets side of the Fundamental Accounting Equation:

- Transaction halves which increase the business assets are "debits" on the left side of the equation.

- Transaction halves which decrease the business assets are "credits".

- On the right or balancing side or Owner's Equity + Liabilities:

- Transaction halves (i.e. the part of the transaction) that increase the Owner's Equity are credits to the company books as they are claims of what the company owes the owner or investor

- Transaction halves that decrease the Owner's Equity (dividends paid or loss writeoffs) are beneficial to the company's future financial position by reducing claims and are considered debits.

- Liabilities incurred by the business entity (which are tracked by the books) are credits

- Liabilities reduced or paid off are debits.

- 3248 reads