Available under Creative Commons-ShareAlike 4.0 International License.

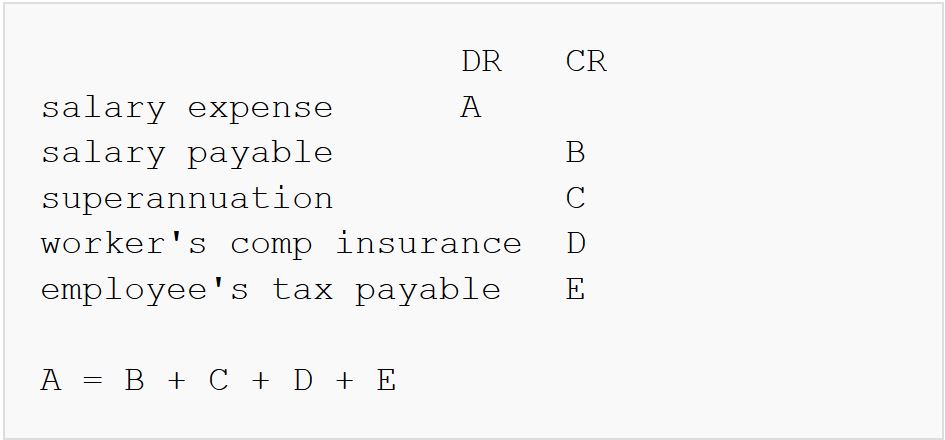

- Some employee liabilities are deductions from gross pay, and can be recorded to offset the salary payable liability ( they reduce the salary payable by accumulating other liabilities payable) , against a total periodic (fortnightly/ monthly ) salary expense.

Common liabilities that fall in this category are the non-expiring ones like superannuation, worker's accident/disability insurance, and pay-as-you-go taxation. Worker's insurance and taxation can be accumulated for lump-sum annual payment.

- Sick leave can be seen as provision type of liability, where an estimate is made based on historical sick leave about amount of total sick leave will be taken in the coming year, and expensed against a provision for sick leave. Since sick leave doesn't accrue from year to year, unused sick leave provision can reduce the next period's sick leave expense ( similar to ageing of accounts receivable bad debts provision ).

- 2189 reads