Available under Creative Commons-ShareAlike 4.0 International License.

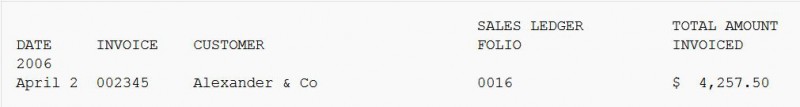

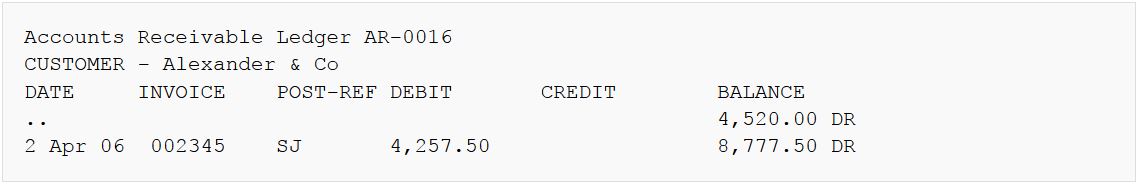

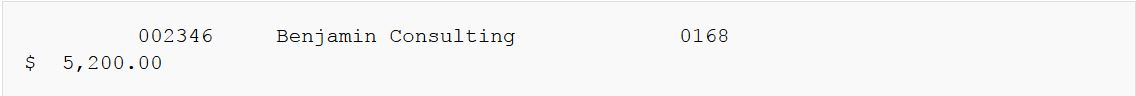

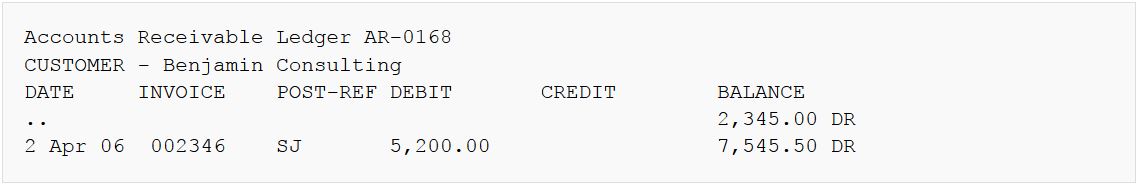

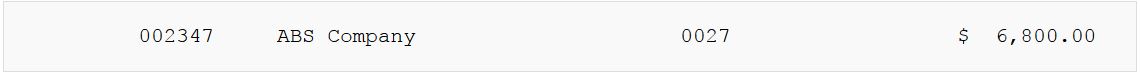

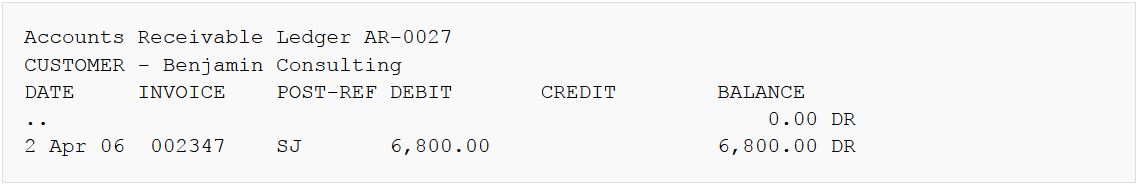

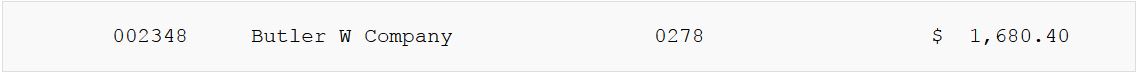

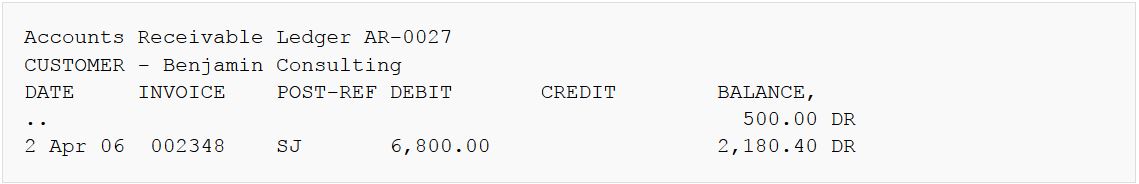

referring to the example above of credit sales journal entry, at the end of the day, the journal entries are posted to the subsidiary receivable account ledgers.

Post as

---

Post as

---

Post as

---

Post as

- Any sales returns journal entries, are also recorded as credits daily in the relevant subsidiary account receivables ledgers.

- Any cash receipts journal entries related to trade debtor settlements are recorded as credits daily in the relevant subsidiary accounts receivables ledgers.

- At the end of the month, a schedule of subsidiary accounts receivable balances is made, and the sum of the balances noted.

- At the end of the month, the total of entries in the sales journal, less the total in the sales returns journal, less the total in the accounts receivable credit column of the cash receipts journal, should equal the total of the schedule of subsidiary accounts receivable.

- credit purchase journal entries are similarly posted in the subsidiary accounts payable daily, as well as cash payment journal entries related to settlement of trade creditor accounts ; similarly monthly total of trade creditor account ending balances should equal totals of credit purchase journal, less credit purchase return journal, less cash payment journal purchase column total.

- any credit purchase or sale of non-current assets such as office furniture and equipment should not be entered in the credit purchases or credit sales journal, which are reserved for recording sale of trade inventory. Since they are non-frequent, they are entered in the general journal instead, and when paid for, are entered in the sundry debit column of the cash payments journal, or the sundry credit column of the cash receipts journal.

- 4872 reads