This serves as a confirmation that what is written down as the current balance at cash in bank account can be eventually accounted for by what is being recorded through the bank statement, as the bank statement is an arm's length record of cash transactions. The aim is to have everything recorded in both the books and the bank statements, and recorded correctly.

- items that appear both in the bank statement and the cash receipts or cash payment journal are likely to be correct , and the item in the bank statement and the relevant journal can be marked off.

- this leaves items in the bank statement, and the journals, that aren't marked off.

- items in the bank statement only, may be missing in the journals.

- items in the journals, may be missing in the bank statement.

- or items in either, may not be correctly entered, either by the bookkeeper ( more likely), or by the bank's bookkeeper (less likely).

- items that were missing in the journals in the last period, may be present in the journals this period (less likely).

- items that were missing in the bank statement last period, may be present in the bank statement this period ( more likely).

- items that haven't been accounted for from previous periods, should be also checked, and accumulated like bad debt records if still not confirmed.

- any items that are found to be bank only recorded transactions, like electronic transfers, bank fees and interest, should be

updated to the journals.

- cash payments journal entries incorrectly recorded can be more easily detected from the bank statement if they were paid by cheque and a correcting entry should be made (in the general journal).

- cash receipts incorrectly recorded may be more easily correlated with bank statements if cash received is banked daily.

- Checking original receipts to customers may help in finding incorrectly recorded receipts in cash receipts journal.

In summary , there is a list of outstanding deposits and payments from the previous reconciliations, which should be checked first against a current bank statement; then run through the cash payments and cash receipts journal sequentially, and tick off each against a corresponding bank statement; unticked bank only items should be written to the journals if missing; anything left in the journals is either outstanding (unpresented cheques, undeposited payments), or incorrect (and written back in the previous step), and should be reversed.

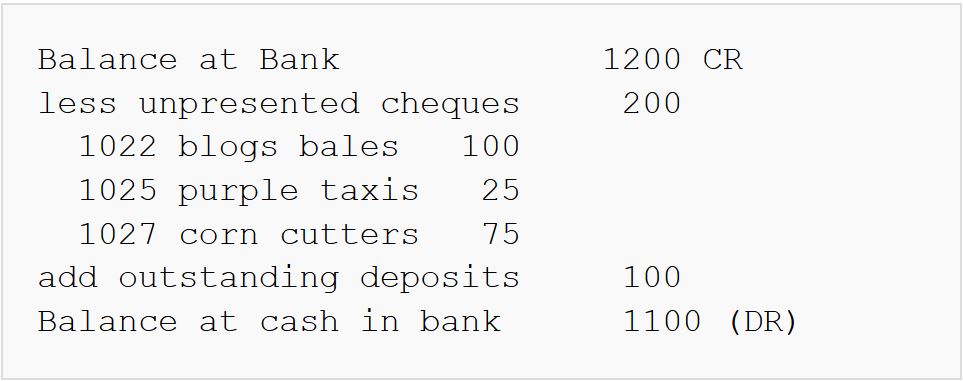

After doing the above, then a bank reconciliation statement can be done (assuming a credit balance at the bank):

- 3071 reads