Assets = Liabilities + Owner's Equity

A central axiom for accounting is the accounting equation above. Depending on the type of company involved, Owner's Equity may be "Shareholder's" or simply "Equity", but the equation holds. The list of all of the accounts (along with their respective account numbers) is called the Chart of Accounts

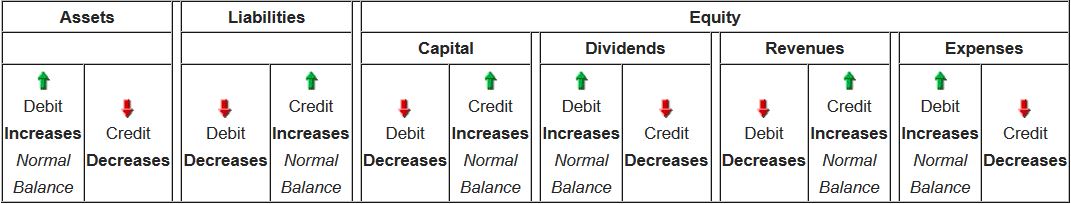

Asset accounts indicate what a company owns. This can be actual possession or the right to take possession, such as a loan extended to another company. Some assets are identifiable by the term "Receivable". Assets have a normal debit balance.

Liability accounts indicate what a company owes to others. Examples of liabilities include loans to be repayed and services that have been paid for that the company hasn't performed yet. Many liabilities can be identified by the term "Payable" in their account name. Liabilities have a normal credit balance.

Equity accounts are a group of accounts that represent the amount of owner's equity in the business. There are four main types of Equity accounts:

- Revenue accounts indicate revenue generated by the normal operations of a business. Fees Earned and Sales are both examples of Revenue accounts. Revenue accounts have a normal credit balance.

- Expense accounts indicate the expenses incurred by a business during normal operations. Most account names ending in "Expense" are classified as expenses. Expenses have a normal debit balance.

- The Owner's Equity or Owner's Capital accounts (for a Proprietorship/Partnership) or the Shareholder's Equity accounts (for a Corporation) indicate the owner's equity in the business. As the accounting equation indicates, equity is the difference between the assets of the company, and the company's debts. Equity accounts are directly affected by Revenue and Expenses, and the standard Equity accounts have Credit balances.

- Dividends represents equity removed from the business by the owners. In a proprietorship or partnership, each owner has an Owner's Withdrawals account. In a corporation, equity is removed by way of dividends, and a Withdrawal account is not needed. Since these accounts represent capital removed from the business, they have a Debit balance.

The effects of debits and credits on the types of accounts is shown on the following table:

- 3162 reads