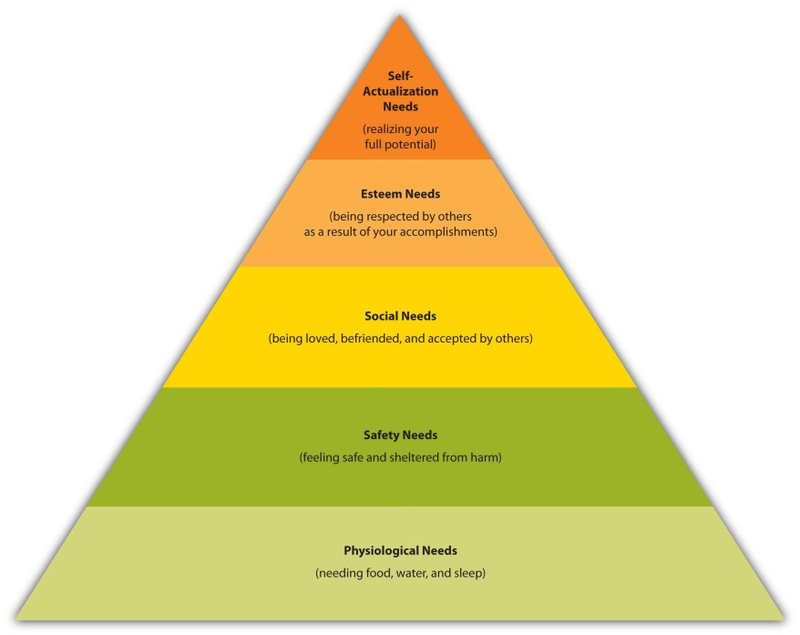

Motivation is the inward drive we have to get what we need. In the mid-1900s, Abraham Maslow, an American psychologist, developed the hierarchy of needs shown in Figure 3.2 Maslow’s Hierarchy of Needs

Maslow theorized that people have to fulfill their basic needs—like the need for food, water, and sleep—before they can begin fulfilling higher-level needs. Have you ever gone shopping when you were tired or hungry? Even if you were shopping for something that would make you envy of your friends (maybe a new car) you probably wanted to sleep or eat even worse. (Forget the car. Just give me a nap and a candy bar.)

People’s needs can be recurring, such as the physiological need for hunger. You eat breakfast and are hungry at lunchtime and then again in the evening. Other needs tend to be enduring, such as the need for shelter, clothing, and safety. Still other needs arise at different points in time in a person’s life. For example, during grade school and high school, your social needs probably rose to the forefront. You wanted to have friends and get a date. Perhaps this prompted you to buy certain types of clothing or electronic devices. After high school, you began thinking about how people would view you in your “station” in life, so you decided to pay for college and get a professional degree, thereby fulfilling your need for esteem. If you’re lucky, at some point you will realize Maslow’s state of self-actualization: You will believe you have become the person in life that you feel you were meant to be.

Marketing professionals understand Maslow’s hierarchy. Take the need for people to feel secure and safe. Following the economic crisis that began in 2008, the sales of new automobiles dropped sharply virtually everywhere around the world—except the sales of Hyundai vehicles. Hyundai ran an ad campaign that assured car buyers they could return their vehicles if they couldn’t make the payments on them without damaging their credit. Other carmakers began offering similar programs after they saw how successful Hyundai had been.

Likewise, banks began offering “worry-free” mortgages to ease the minds of would-be homebuyers. For a fee of about $500, First Mortgage Corp., a Texas-based bank, offered to make a homeowner’s mortgage payment for six months if he or she got laid off. 1

- 3447 reads