The M/S process performs the critical tasks of (1) processing customer orders and (2) shipping goods to customers. The RC process completes the Order-to-Cash business process by accomplishing three separate yet related activities: (1) billing customers, (2) managing customer accounts, and (3) securing payment for goods sold or services rendered.

The revenue collection (RC) process is an interacting structure of people, equipment, methods, and controls designed to:

- Support the repetitive work routines of the credit department, the cashier, and the accounts receivable department1

- Support the problem-solving processes of financial managers

- Assist in the preparation of internal and external reports

- Create information flows and recorded data in support of the operations and management processes

|

Review Question What is the revenue collection (RC) process? |

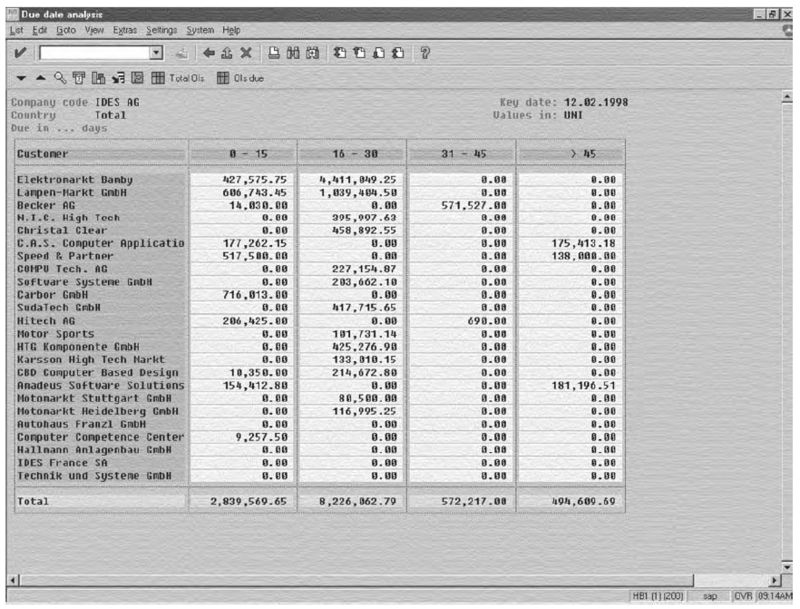

First, the RC process supports the repetitive work routines by capturing, recording, and communicating data resulting from the tasks of billing customers, managing customer accounts, and collecting amounts due from customers. Next, the RC process supports the problem-solving processes involved in managing the revenue stream of the company. As but one example, the credit manager, reporting to the treasurer, might use an accounts receivable aging report such as the one in Figure 12.1 to make decisions about extending further credit to customers, pressing customers for payment, or writing off worthless accounts. Third, the RC process assists in the preparation of internal and external reports, such as those demanded by investors and bankers. Finally, the information process creates information flows and stored data to support the operations processes and decision-making requirements associated with the process.

|

Review Question What primary functions does the RC process perform? Explain each function. |

The RC process occupies a position of critical importance to an organization. For example, an organization needs a rapid billing process, followed by close monitoring of receivables, and a quick cash collections process to convert sales into cash in a timely manner. Keeping receivables at a minimum should be a major objective of an RC process. While we tend to associate the RC process with mundane recordkeeping activities, the process also can be used to improve customer relations and competitive advantage. First, let’s take a look at the organizational aspects of the RC process.

- 4482 reads