As discussed earlier, the procedures employed in collecting cash vary widely. For example, some companies ask customers to mail checks along with remittance advices to the company, others ask customers to send payments to a designated bank lockbox, while in e-business environments some form of electronic funds transfer is generally used.

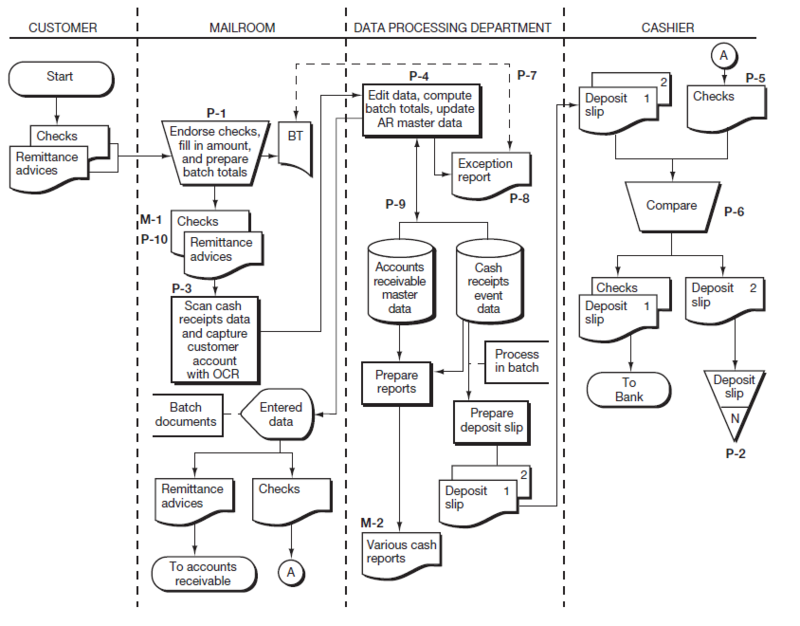

Figure 12.10 depicts a process in which customer payments arrive by mail. The source documents include checks and remittance advices.

Each day, the process begins with mailroom clerks opening the mail. Immediately, the clerks endorse all checks. They assemble enclosed statements (remittance advices that come in the form of billing statement detachments from the customer invoice—i.e., turnaround documents) in batches and prepare batch totals for control purposes. The receipts data—batch total and remittance details from the customer billing statements—are then entered into the computer system via a scanning process and use of optical character recognition technology in the mailroom. The computer edits the data as they are entered and computes batch totals. Once the data are verified, details are written to the cash receipts event data. The batched statements are sent to the accounts receivable department for filing, and the checks are transferred to the cashier.

For most processes of the type illustrated in Figure 12.10, input requirements are minimal. As indicated, the editing process verifies the correctness of the entered data, including customer number and so forth. By accessing open invoice data that reside within the accounts receivable master data, the process also verifies that any cash discounts taken by the customer are legitimate (i.e., they have been authorized). To check the dollar amount of each invoice remitted, the system calculates the balance due by adding the cash payment to the cash discount taken (if any); it then compares the computed balance-due total to the balance-due total scanned in by the mailroom clerk.

TECHNOLOGY INSIGHT 11.4

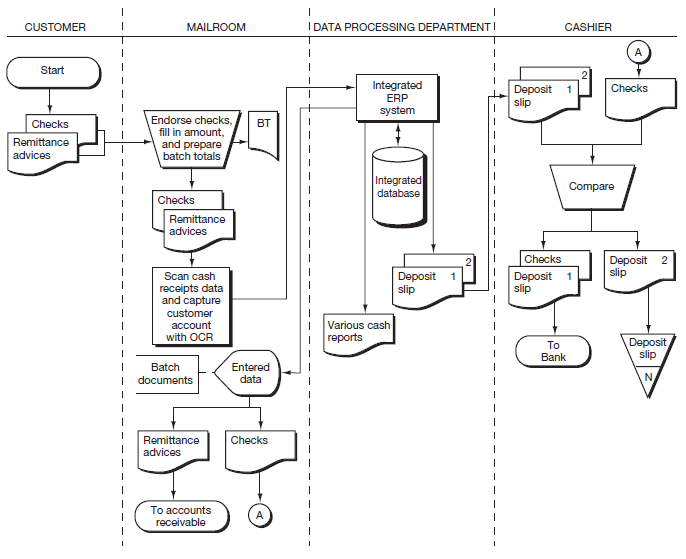

Enterprise System Support for the Cash Receipts Process

The main effect of the introduction of an enterprise system into the M/S process depicted in Figure 12.10 is the integration of the processing programs and the various data stores into a single unified processing system with a single underlying database. In terms of the diagrams, the primary impact is therefore on the activities depicted within the “data processing department.” These changes are demonstrated in the diagram below.

Once the data have passed all the control checks, the accounts receivable master data are updated. Also, the computer generates various cash reports and prepares the deposit slip. The deposit slip is transferred to the cashier. The cashier compares the checks and the deposit slip; if they agree, all documents are sent to the bank.

Once you have had the opportunity to study the cash receipts process documented in Figure 12.10, consider how this process might change in an enterprise system environment. After you have thought through the impact and the resulting changes to Figure 12.10, read Technology Insight 11.4, which provides an overview of how a fully implemented enterprise system affects the cash receipts process discussed in this chapter.

- 21895 reads