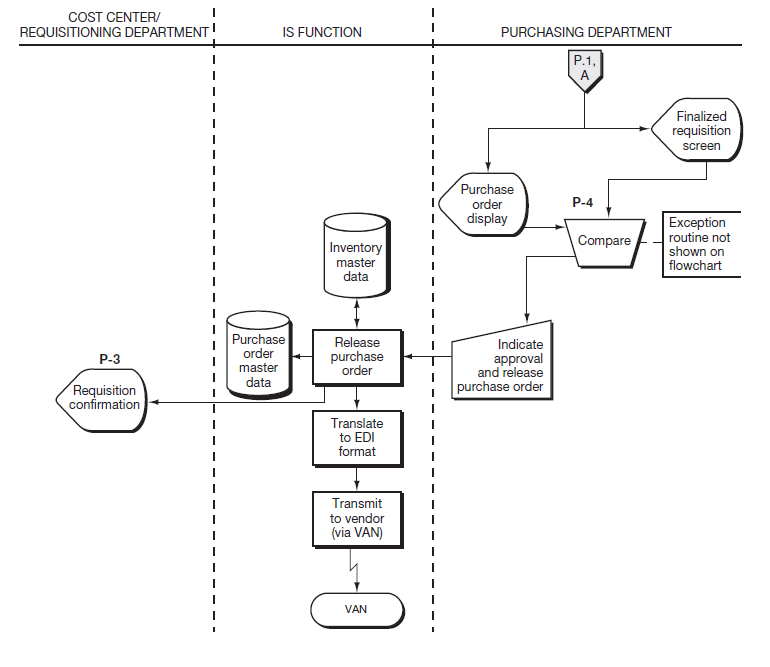

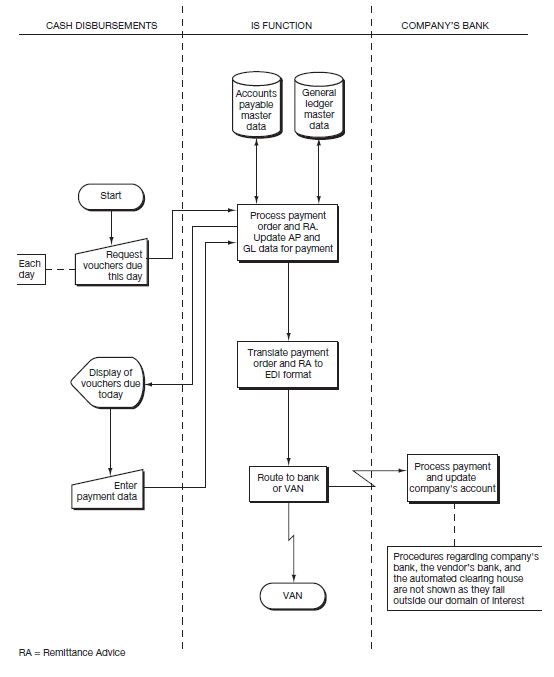

Figure 13.7, Figure 13.8, Figure 13.9, and Figure 13.10presents a systems flowchart of the process. At several points in the flowchart, you see notations that exception routines are not flowcharted. They are also omitted from the discussion in the following paragraphs.

Technology Excerpt 12.1

Online Bill Presentment and Payment

Although most of the hype in online billing is for business-to-consumer billing (such as utilities and communication companies), more than half of the 20 billion electronic bills issued each year are to businesses. New bill payment service providers let companies receive electronic bills and pay them directly from their bank account.

How This Saves Money

- Lower cost per bill payment. Traditional paper-based payments including stamps, checks, and envelopes cost about $0.50–$1.50 each. For about 25 monthly online payments, the cost per payment ranges from $0.24 to $80, depending on the vendor and additional services selected.

- Save time by receiving e-mail notification of new bills and paying them online instead of offline. The time it takes to manually open envelopes and print checks is significantly reduced. Helpful features like receiving e-mail reminders of bills due and designating bills for automatic payment also save time.

- Companies can even make interest off the float in their bank accounts by controlling exactly when payments are made.

Source: www.dotcomadvisor.com, September 20, 2000.

Requisition and Order Merchandise As shown in the first column, the purchasing process begins when a cost center employee establishes a need and completes a requisition form on the computer system. When a requisitioner calls up the system, the system automatically supplies a four-digit requisition number. The requisitioner designates the items desired, as well as information about the cost center making the request.

The completed requisition is routed via the system to a cost center supervisor for approval. Depending on the amount and nature of the requisition, several approvals may be required. Approval is granted in the system by forwarding the requisition to the next person on the list; approval codes are attached to the record along the way and are displayed in the appropriate boxes on the requisition form. The approved requisition is automatically recorded to the audit data and routed to the purchasing department.

In the purchasing department, a buyer checks the requisition for proper approval by matching the codes against “authorized approver” data. Then, vendor candidates are chosen by consulting the inventory and vendor master data. Final vendor selection and price determination may require contact with the potential vendor. When the vendor choice is settled, the buyer updates the requisition by adding any necessary details.

|

|

Next, the system displays the purchase order (see the second page of the flowchart), and the buyer or the purchasing manager checks the purchase order data on the screen against the requisition data on the screen. The manager then approves the purchase order, a system confirmation is made available to the requisitioner, a record is created in the purchase order master data, and the inventory records are updated to reflect the quantity on order. The purchasing process releases the PO to the EDI translator, where it is converted to the appropriate EDI format. The translation software also encrypts the EDI message and appends a digital signature to it (as discussed in CONTROLLING INFORMATION SYSTEMS: PROCESS CONTROLS). |

Receive Merchandise On the third page of the flowchart, we see that receiving department personnel receive and count the merchandise sent by the vendor. They compare the items and item quantities received to those on the open purchase order master data.1 If the shipment is correct, they enter the receiving data into the computer. This information creates a record in the receiving report data, updates the status field in the purchase order data, and records the receipt in the inventory master data. The shipping documents are filed in chronological sequence for audit trailpurposes. Alternatively, an image of the shipping documents might be stored on the computer.

|

|

Establish Accounts Payable The organization’s system picks up the vendor’s invoice from the Value-Added Network (VAN) and routes it to the EDI translator. The EDI translator converts the invoice to the appropriate format and records it in the incoming invoice data. Triggered by the receipt of a batch of EDI invoices, the accounts payable application accesses the purchase order and receiving report data and compares the items, quantities, prices, and terms on the invoice to comparable data from the PO and receiving report data. If the data correspond, a payable is created, and the general ledger is updated. The purchase order, receiving report, and invoice data must be marked so that it cannot be used to establish another payable. |

|

|

Make Payments The physical model depicted on the fourth flowchart page utilizes EDI to make the payment. Banks that are members of the National Automated Clearing House (ACH) Association combine EDI and electronic funds transfer (EFT) standards to transmit electronic payments between companies and their trading partners. |

As shown in Figure 13.7, the accounts payable master data are searched each day for approved vendor invoices due that day. The cash disbursements application prepares the payment order and remittance advice, updates the accounts payable master data and the general ledger for the payment, and sends the data on to the EDI translator. The translator converts the data to the appropriate format, encrypts the message, adds a digital signature, and sends the EDI payment order and remittance advice on to the communications network.

If the bank is acting as a VAN for the payment order, the communications network sends the data to the bank. Otherwise, the system sends the payment order to a VAN for pickup by the bank. The bank debits the account and then sends the payment order to an automated clearinghouse for processing. Next, the automated clearinghouse sends the data to the vendor’s bank, where it is automatically credited to the vendor’s bank account. Finally, the vendor’s bank transmits the RA and payment data to the vendor. If the electronic remittance advice does not accompany the payment order through the banking system, it would be forwarded directly (via VAN) to the supplier.2

|

|

Consider how this process might change in an enterprise systems environment. After you have thought through the impact and the resulting changes to Figure 13.7, read Technology Insight 12.3, which provides an overview of how a fully implemented enterprise system affects the PtoP process discussed in this chapter. |

- 7013 reads