While there is less consensus on macroeconomic policy issues than on some other economic issues (particularly those in the microeconomic and international areas), surveys of economists generally show that the new Keynesian approach has emerged as the preferred approach to macroeconomic analysis. The finding that about 80% of economists agree that expansionary fiscal measures can deal with recessionary gaps certainly suggests that most economists can be counted in the new Keynesian camp. Neither monetarist nor new classical analysis would support such measures. At the same time, there is considerable discomfort about actually using discretionary fiscal policy, as the same survey shows that about 70% of economists feel that discretionary fiscal policy should be avoided and that the business cycle should be managed by the Fed.[3] Just as the new Keynesian approach appears to have won support among most economists, it has become dominant in terms of macroeconomic policy.

As we have seen, the Fed established a commitment in 1979 to keeping inflation under control. As long as inflation does not become excessive—any rate above 3% appears to qualify as excessive—the Fed will seek to close inflationary or recessionary gaps with monetary policy. The Fed used expansionary monetary policy to respond to the 1990–1991 recession and switched to contractionary policy in 1994 to prevent an inflationary gap. The Fed adjusted monetary policy frequently in the second half of the 1990s as it tried to steer the economy through global monetary crises, apparent shifts in money demand, and fears the economy had pushed into another inflationary gap.

There will always be controversy concerning the appropriate policy response to a particular situation. Such disagreements, however, should not keep us from recognizing the amount of consensus among economists that appears to have emerged. Most economists now subscribe to ideas that we can associate with the new Keynesian approach to macroeconomics. The success of the new Keynesian school results in part from the ideas of Keynes himself and in part from the ability of new Keynesian economists to incorporate monetarist and new classical ideas in their thinking. Controversy continues, but there is much agreement, and that agreement has affected macroeconomic policy.

KEY TAKEAWAYS

- The actions of the Fed starting in late 1979 reflected a strong inflation constraint and a growing recognition of the impact lag for monetary policy.

- Reducing the deficit dominated much of fiscal policy discussion during the 1980s and 1990s.

- The events of the 1980s and early 1990s do not appear to have been consistent with the hypotheses of either the monetarist or new classical schools.

- New Keynesian economists have incorporated major elements of the ideas of the monetarist and new classical schools into their formulation of macroeconomic theory.

TRY IT!

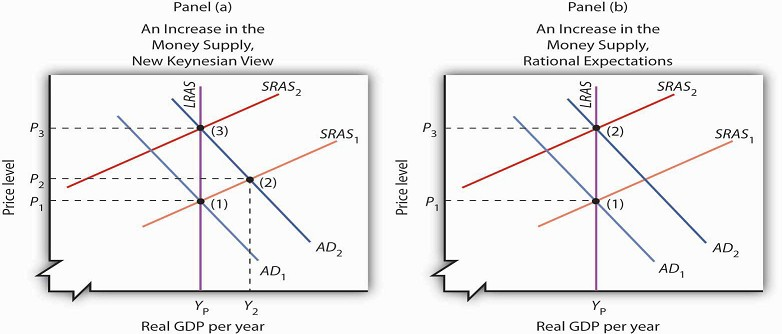

Show the effect of an expansionary monetary policy on real GDP

- according to new Keynesian economics

- according to the rational expectations hypothesis

In both cases, consider both the short-run and the long-run effects.

Case in Point: Steering on a Difficult Course

Imagine that you are driving a test car on a special course. You get to steer, accelerate, and brake, but you cannot be sure whether the car will respond to your commands within a few feet or

within a few miles. The windshield and side windows are blackened, so you cannot see where you are going or even where you are. You can only see where you have been with the rear-view mirror.

The course is designed so that you will face difficulties you have never experienced. Your job is to get through the course unscathed. Oh, and by the way, you have to observe the speed limit,

but you do not know what it is. Have a nice trip.

Now imagine that the welfare of people all over the world will be affected by how well you drive the course. They are watching you. They are giving you a great deal of often-conflicting

advice about what you should do. Thinking about the problems you would face driving such a car will give you some idea of the obstacle course fiscal and monetary authorities must egotiate.

They cannot know where the economy is going or where it is—economic indicators such as GDP and the CPI only suggest where the economy has been. And the perils through which it must steer can

be awesome indeed.

One policy response that most acknowledge as having been successful was how the Fed dealt with the financial crises in Southeast Asia and elsewhere that shook the world economy in 1997 and

1998. There were serious concerns at the time that economic difficulties around the world would bring the high-flying U.S. economy to its knees and worsen an already difficult economic

situation in other countries. The Fed had to steer through the pitfalls that global economic crises threw in front of it.

In the fall of 1998, the Fed chose to accelerate to avoid a possible downturn. The Federal Open Market Committee (FOMC) engaged in expansionary monetary policy by lowering its target for the

federal funds rate. Some critics argued at the time that the Fed’s action was too weak to counter the impact of world economic crisis. Others, though, criticized the Fed for undertaking an

expansionary policy when the U.S. economy seemed already to be in an inflationary gap.

In the summer of 1999, the Fed put on the brakes, shifting back to a slightly contractionary policy. It raised the target for the federal funds rate, first to 5.0% and then to 5.25%. These

actions reflected concern about speeding when in an inflationary gap.

But was the economy speeding? Was it in an inflationary gap? Certainly, the U.S. unemployment rate of 4.2% in the fall of 1999 stood well below standard estimates of the natural rate of

unemployment. There were few, if any, indications that inflation was a problem, but the Fed had to recognize that inflation might not appear for a very long time after the Fed had taken a

particular course. As noted in the text, this was also during a time when the once-close relationship between money growth and nominal GDP seemed to break down. The shifts in demand for money

created unexplained and unexpected changes in velocity.

The outcome of the Fed’s actions has been judged a success. While with 20/20 hindsight the Fed’s decisions might seem obvious, in fact it was steering a car whose performance seemed less and

less predictable over a course that was becoming more and more treacherous.

Since 2008, both the Fed and the government have been again trying to get the economy back on track. In this case, the car is already in the ditch. The Fed has decided on a “no holds barred”

approach. It has moved aggressively to lower the federal funds rate target and engaged in a variety of other measures to improve liquidity to the banking system, to lower other interest rates

by purchasing longer-term securities (such as 10-year treasuries and those of Fannie Mae and Freddie Mac), and, working with the Treasury Department, to provide loans related to consumer and

business debt.

The Obama administration for its part advocated and Congress passed a massive spending and tax relief package of about $800 billion. Besides the members of his economic team, many economists

seem to be on board in using discretionary fiscal policy in this instance. Federal Reserve Bank of San Francisco President Janet Yellen put it this way: “The new enthusiasm for fiscal

stimulus, and particularly government spending, represents a huge evolution in mainstream thinking.” A notable convert to using fiscal policy to deal with this recession was Harvard economist

and former adviser to President Ronald Reagan, Martin Feldstein. His spending proposal encouraged increased military spending and he stated, “While good tax policy can contribute to ending

the recession, the heavy lifting will have to be done by increased government spending.”

Predictably, not all economists have jumped onto the fiscal policy bandwagon. Concerns included whether so-called shovel-ready projects could really be implemented in time, whether government

spending would crowd out private spending, whether monetary policy alone was providing enough stimulus, and whether the spending would flow efficiently to truly worthwhile projects. According

to University of California-Berkeley economist Alan J. Auerbach, “We have spent so many years thinking that discretionary fiscal policy was a bad idea, that we have not figured out the right

things to do to cure a recession that is scaring all of us.”

Sources: Ben S. Bernanke, “The Crisis and the Policy Response” (speech, London School of Economics, January 13, 2009); Louis Uchitelle, “Economists

Warm to Government Spending but Debate Its Form,” New York Times, January 7, 2009, p. B1.

ANSWER TO TRY IT! PROBLEM

Panel (a) shows an expansionary monetary policy according to new Keynesian economics. Aggregate demand increases, with no immediate reduction in short-run aggregate supply. Real GDP rises to

Y2. In the long run, nominal wages rise, reducing short-run aggregate supply and returning real GDP to potential. Panel (b) shows what happens with rational expectations. When the Fed

increases the money supply, people anticipate the rise in prices. Workers and firms agree to an increase in nominal wages, so that there is a reduction in shortrun aggregate supply at the

same time there is an increase in aggregate demand. The result is no change in real GDP; it remains at potential. There is, however, an increase in the price level.

- 2700 reads