Public policy can have significant effects on the demand for capital. Such policies typically seek to affect the cost of capital to firms. The Kennedy administration introduced two such strategies in the early 1960s. One strategy, accelerated depreciation, allowed firms to depreciate capital assets over a very short period of time. They could report artificially high production costs in the first years of an asset’s life and thus report lower profits and pay lower taxes. Accelerated depreciation did not change the actual rate at which assets depreciated, of course, but it cut tax payments during the early years of the assets’ use and thus reduced the cost of holding capital.

The second strategy was the investment tax credit, which permitted a firm to reduce its tax liability by a percentage of its investment during a period. A firm acquiring new capital could subtract a fraction of its cost—10% under the Kennedy administration’s plan—from the taxes it owed the government. In effect, the government “paid” 10% of the cost of any new capital; the investment tax credit thus reduced the cost of capital for firms.

Though less direct, a third strategy for stimulating investment would be a reduction in taxes on corporate profits (called the corporate income tax). Greater after-tax profits mean that firms can retain a greater portion of any return on an investment.

A fourth measure to encourage greater capital accumulation is a capital gains tax rate that allows gains on assets held during a certain period to be taxed at a different rate than other income. When an asset such as a building is sold for more than its purchase price, the seller of the asset is said to have realized a capital gain. Such a gain could be taxed as income under the personal income tax. Alternatively, it could be taxed at a lower rate reserved exclusively for such gains. A lower capital gains tax rate makes assets subject to the tax more attractive. It thus increases the demand for capital. Congress reduced the capital gains tax rate from 28% to 20% in 1996 and reduced the required holding period in 1998. The Jobs and Growth Tax Relief Reconciliation Act of 2003 reduced the capital gains tax further to 15% and also reduced the tax rate on dividends from 38% to 15%. A proposal to eliminate capital gains taxation for smaller firms was considered but dropped before the stimulus bill of 2009 was enacted.

Accelerated depreciation, the investment tax credit, and lower taxes on corporate profits and capital gains all increase the demand for private physical capital. Public policy can also affect the demands for other forms of capital. The federal government subsidizes state and local government production of transportation, education, and many other facilities to encourage greater investment in public sector capital. For example, the federal government pays 90% of the cost of investment by local government in new buses for public transportation.

KEY TAKEAWAYS

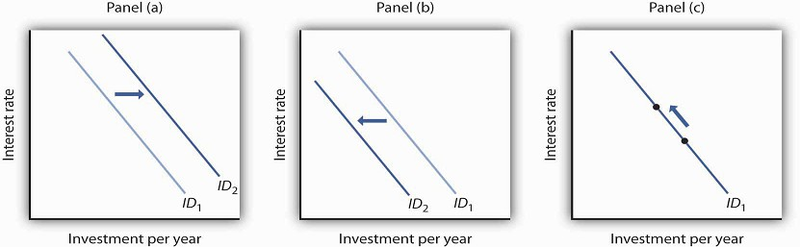

- The quantity of investment demanded in any period is negatively related to the interest rate. This relationship is illustrated by the investment demand curve.

- A change in the interest rate causes a movement along the investment demand curve. A change in any other determinant of investment causes a shift of the curve.

- The other determinants of investment include expectations, the level of economic activity, the stock of capital, the capacity utilization rate, the cost of capital goods, other factor costs, technological change, and public policy.

TRY IT!

Show how the investment demand curve would be affected by each of the following:

- A sharp increase in taxes on profits earned by firms

- An increase in the minimum wage

- The expectation that there will be a sharp upsurge in the level of economic activity

- An increase in the cost of new capital goods

- An increase in interest rates

- An increase in the level of economic activity

- A natural disaster that destroys a significant fraction of the capital stock

Case in Point: Assessing the Impact of a One-Year Tax Break on Investment

The U.S. economy was expanding in 2004, but there was a feeling that it still was not functioning as well as it could, as job growth was rather sluggish. To try to spur growth, Congress,

supported by President Bush, passed a law in 2004 called the American Jobs Creation Act that gave businesses a one-year special tax break on any profits accumulating overseas that were

transferred to the United States. Such profits are called repatriated profits and were estimated at the time to be about $800 billion. For 2005, the tax rate on repatriated profits

essentially fell from 25% to 5.25%.

Did the tax break have the desired effect on the economy? To some extent yes, though business also found other uses for the repatriated funds. There were 843 companies that repatriated $312

billion that qualified for the tax break. The Act thus generated about $18 billion in tax revenue, a higher level than had been expected. Some companies announced they were repatriating

profits and continuing to downsize. For example, Colgate-Palmolive brought back $800 million and made known it was closing a third of its factories and eliminating 12% of its workforce.

However, other companies’ plans seemed more in line with the objectives of the special tax break—to create jobs and spur investment.

For example, spokesman Chuck Mulloy of Intel, which repatriated over $6 billion, said the company was building a $3-billion wafer fabrication facility and spending $345 million on expanding

existing facilities. “I can’t say dollar-for-dollar how much of the funding for those comes from off-shore cash,” but he felt that the repatriated funds were contributing to Intel’s overall

investments. Spokeswoman Margaret Graham of Bausch and Lomb, which makes eye-care products and repatriated $805 million, said, “We plan to use that cash for capital expenditures, investment

in research and development, and paying nonofficer compensation.”

Analysts are skeptical, though, that the repatriated profits really contributed to investment. The New York Times reported on one study that suggested it had not. Rather, the repatriated

funds were used for other purposes, such as stock repurchases. The argument is that the companies made investments that they were planning to make and the repatriated funds essentially freed

up funding for other purposes.

Sources: Timothy Aeppel, “Tax Break Brings Billion to U.S., But Impact on Hiring Is Unclear,” Wall Street Journal, October 5, 2005, p. A1; Lynnley Browning, “A One-Time Tax Break Saved

843 U.S. Corporations $265 Billion,” New York Times, June 24, 2008, p. C3.

ANSWER TO TRY IT! PROBLEMS

- The investment demand curve shifts to the left: Panel (b).

- A higher minimum wage makes labor more expensive. Firms are likely to shift to greater use of capital, so the investment demand curve shifts to the right: Panel (a).

- The investment demand curve shifts to the right: Panel (a).

- The investment demand curve shifts to the left: Panel (b).

- An increase in interest rates causes a movement along the investment demand curve: Panel (c).

- The investment demand curve shifts to the right: Panel (a).

- The need to replace capital shifts the investment demand curve to the right: Panel (a).

- 3575 reads