The total quantity of money in the economy at any one time is called the money supply. Economists measure the money supply because it affects economic activity. What should be included in the money supply? We want to include as part of the money supply those things that serve as media of exchange.However, the items that provide this function have varied over time.

Before 1980, the basic money supply was measured as the sum of currency in circulation, traveler’s checks, and checkable deposits. Currency serves the medium-of-exchange function very nicely but denies people any interest earnings. (Checking accounts did not earn interest before 1980.)

Over the last few decades, especially as a result of high interest rates and high inflation in the late 1970s, people sought and found ways of holding their financial assets in ways that earn interest and that can easily be converted to money. For example, it is now possible to transfer money from your savings account to your checking account using an automated teller machine (ATM), and then to withdraw cash from your checking account. Thus, many types of savings accounts are easily converted into currency.

Economists refer to the ease with which an asset can be converted into currency as the asset’s liquidity.Currency itself is perfectly liquid; you can always change two $5 bills for a $10 bill. Checkable deposits are almost perfectly liquid; you can easily cash a check or visit an ATM. An office building,however, is highly illiquid. It can be converted to money only by selling it, a time-consuming and costly process.

As financial assets other than checkable deposits have become more liquid, economists have had to develop broader measures of money that would correspond to economic activity. In the United States,the final arbiter of what is and what is not measured as money is the Federal Reserve System. Because it is difficult to determine what (and what not) to measure as money, the Fed reports several different measures of money, including M1 and M2.

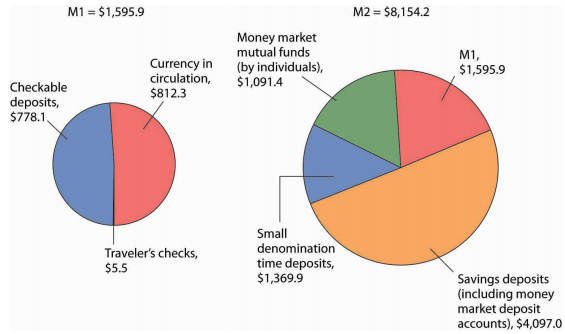

M1 is the narrowest of the Fed’s money supply definitions. It includes currency in circulation,checkable deposits, and traveler’s checks. M2 is a broader measure of the money supply than M1. It includes M1 and other deposits such as small savings accounts (less than $100,000), as well as accounts such as money market mutual funds (MMMFs) that place limits on the number or the amounts of the checks that can be written in a certain period.

M2 is sometimes called the broadly defined money supply, while M1 is the narrowly defined money supply. The assets in M1 may be regarded as perfectly liquid; the assets in M2 are highly liquid, but somewhat less liquid than the assets in M1. Even broader measures of the money supply include large time-deposits, money market mutual funds held by institutions, and other assets that are somewhat less liquid than those in M2. Figure 24.1 shows the composition of M1 and M2 in December 2008.

M1, the narrowest definition of the money supply, includes assets that are perfectly liquid. M2 provides a broader measure of the money supply and includes somewhat less liquid assets. Amounts represent money supply data in billions of dollars for December 2008.

Source: Federal Reserve Statistical Release H.6, Tables 3 and 4 (January 29, 2009).

Heads Up!

Credit cards are not money. A credit card identifies you as a person who has a special arrangement with the card issuer in which the issuer will lend you money and transfer the proceeds to another party whenever you want. Thus, if you present a MasterCard to a jeweler as payment for a $500 ring, the firm that issued you the card will lend you the $500 and send that money, less a service charge, to the jeweler. You, of course, will be required to repay the loan later. But a card that says you have such a relationship is not money, just as your debit card is not money.

With all the operational definitions of money available, which one should we use? Economists generally answer that question by asking another: Which measure of money is most closely related to real GDP and the price level? As that changes, so must the definition of money.

In 1980, the Fed decided that changes in the ways people were managing their money made M1 useless for policy choices. Indeed, the Fed now pays little attention to M2 either. It has largely given up tracking a particular measure of the money supply. The choice of what to measure as money remains the subject of continuing research and considerable debate.

KEY TAKEAWAYS

- Money is anything that serves as a medium of exchange. Other functions of money are to serve as a unit of account and as a store of value.

- Money may or may not have intrinsic value. Commodity money has intrinsic value because it has other uses besides being a medium of exchange. Fiat money serves only as a medium of exchange, because its use as such is authorized by the government; it has no intrinsic value.

- The Fed reports several different measures of money, including M1 and M2.

TRY IT!

Which of the following are money in the United States today and which are not? Explain your reasoning in terms of the functions of money.

- Gold

- A Van Gogh painting

- A dime

Case in Point: Fiat-less Money

“We don’t have a currency of our own,” proclaimed Nerchivan Barzani, the Kurdish regional government’s prime minister in a news interview in 2003. But, even without official recognition by the government, the socalled “Swiss” dinar certainly seemed to function as a fiat money. Here is how the Kurdish area of northern Iraq, during the period between the Gulf War in 1991 and the fall of Saddam Hussein in 2003, came to have its own currency, despite the pronouncement of its prime minister to the contrary. After the Gulf War, the northern, mostly Kurdish area of Iraq was separated from the rest of Iraq though the enforcement of the no-fly-zone. Because of United Nations sanctions that barred the Saddam Hussein regime in the south from continuing to import currency from Switzerland, the central bank of Iraq announced it would replace the “Swiss” dinars, so named because they had been printed in Switzerland, with locally printed currency,which became known as “Saddam” dinars. Iraqi citizens in southern Iraq were given three weeks to exchange their old dinars for the new ones. In the northern part of Iraq, citizens could not exchange their notes and so they simply continued to use the old ones. And so it was that the “Swiss” dinar for a period of about 10 years, even without government backing or any law establishing it as legal tender, served as northern Iraq’s fiat money. Economists use the word “fiat,” which in Latin means “let it be done,” to describe money that has no intrinsic value. Such forms of money usually get their value because a government or authority has declared them to be legal tender, but, as this story shows, it does not really require much “fiat” for a convenient, in-and-of-itself worthless, medium of exchange to evolve. What happened to both the “Swiss” and “Saddam” dinars? After the Coalition Provisional Authority (CPA) assumed control of all of Iraq, Paul Bremer, then head of the CPA, announced that a new Iraqi dinar would be exchanged for both of the existing currencies over a three-month period ending in January 2004 at a rate that implied that one “Swiss” dinar was valued at 150 “Saddam” dinars. Because Saddam Hussein’s regime had printed many more “Saddam” dinars over the 10-year period, while no “Swiss” dinars had been printed, and because the cheap printing of the “Saddam” dinars made them easy to counterfeit, over the decade the “Swiss” dinars became relatively more valuable and the exchange rate that Bremer offered about equalized the purchasing power of the two currencies. For example, it took about 133 times as many “Saddam” dinars as “Swiss” dinars to buy a man’s suit in Iraq at the time. The new notes, sometimes called “Bremer” dinars, were printed in Britain and elsewhere and flown into Iraq on 22 flights using Boeing 747s and other large aircraft. In both the northern and southern parts of Iraq, citizens turned in their old dinars for the new ones, suggesting at least more confidence at that moment in the “Bremer” dinar than in either the “Saddam” or “Swiss” dinars. Sources: Mervyn A. King, “The Institutions of Monetary Policy” (lecture, American Economics Association Annual Meeting, San Diego, January 4, 2004),available at http://www.bankofengland.co.uk/speeches/speech208.pdf. Hal R. Varian, “Paper Currency Can Have Value without Government Backing,but Such Backing Adds Substantially to Its Value,” New York Times, January 15, 2004, p. C2.

ANSWER TO TRY IT! PROBLEM

- a. Gold is not money because it is not used as a medium of exchange. In addition, it does not serve as a unit of account. It may, however, serve as a store of value.

- b. A Van Gogh painting is not money. It serves as a store of value. It is highly illiquid but could eventually be converted to money. It is neither a medium of exchange nor a unit of account.

- c. A dime is money and serves all three functions of money. It is, of course, perfectly liquid.

- 4209 reads