In our model, unemployment above the natural level occurs if, at a given real wage, the quantity of labor supplied exceeds the quantity of labor demanded. In the analysis we’ve done so far, the failure to achieve equilibrium is a short-run phenomenon. In the long run, wages and prices will adjust so that the real wage reaches its equilibrium level. Employment reaches its natural level.

Some economists, however, argue that a real wage that achieves equilibrium in the labor market may never be reached. They suggest that firms may intentionally pay a wage greater than the market equilibrium. Such firms could hire additional workers at a lower wage, but they choose not to do so. The idea that firms may hold to a real wage greater than the equilibrium wage is called efficiencywage theory.

Why would a firm pay higher wages than the market requires? Suppose that by paying higher wages, the firm is able to boost the productivity of its workers. Workers become more contented and more eager to perform in ways that boost the firm’s profits. Workers who receive real wages above the equilibrium level may also be less likely to leave their jobs. That would reduce job turnover. A firm that pays its workers wages in excess of the equilibrium wage expects to gain by retaining its employees and by inducing those employees to be more productive. Efficiency-wage theory thus suggests that the labor market may divide into two segments. Workers with jobs will receive high wages. Workers without jobs, who would be willing to work at an even lower wage than the workers with jobs, find themselves closed out of the market.

Whether efficiency wages really exist remains a controversial issue, but the argument is an important one. If it is correct, then the wage rigidity that perpetuates a recessionary gap is transformed from a temporary phenomenon that will be overcome in the long run to a permanent feature of the market. The argument implies that the ordinary processes of self-correction will not eliminate a recessionary gap.

KEY TAKEAWAYS

- Two factors that can influence the rate of inflation in the long run are the rate of money growth and the rate of economic growth.

- In the long run, the Phillips curve will be vertical since when output is at potential, the unemployment rate will be the natural rate of unemployment, regardless of the rate of inflation.

- The rate of frictional unemployment is affected by information costs and by the existence of unemployment compensation.

- Policies to reduce structural unemployment include the provision of job training and information about labor-market conditions in other regions.

- Efficiency-wage theory predicts that profit-maximizing firms will maintain the wage level at a rate too high to achieve full employment in the labor market.

TRY IT!

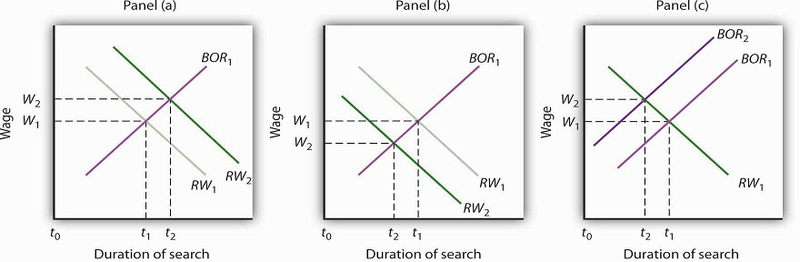

Using the model of a job search (see Figure 31.15), show graphically how each of the following would be likely to affect the duration of an unemployed worker’s job search and thus the unemployment rate:

- A new program provides that workers who have lost their jobs will receive unemployment compensation from the government equal to the pay they were earning when they lost their jobs, and that this compensation will continue for at least five years.

- Unemployment compensation is provided, but it falls by 20% each month a person is out of work.

- Access to the Internet becomes much more widely available and is used by firms looking for workers and by workers seeking jobs.

Case in Point: Altering the Incentives for Unemployment Insurance Claimants

While the rationale for unemployment insurance is clear—to help people weather bouts of unemployment— especially during economic downturns, designing programs that reduce adverse incentives

is challenging. A review article by economists Peter Fredriksson and Bertil Holmlund examined decades of research that looks at how unemployment insurance programs could be improved. In

particular, they consider the value of changing the duration and profile of benefit payments, increasing monitoring and sanctions imposed on unemployment insurance recipients, and changing

work requirements. Some of the research is theoretical, while some comes out of actual experiments.

Concerning benefit payments, they suggest that reducing payments over time provides better incentives than either keeping payments constant or increasing them over time. Research also

suggests that a waiting period might also be useful. Concerning monitoring and sanctions, most unemployment insurance systems require claimants to demonstrate in some way that they have

looked for work. For example, they must report regularly to employment agencies or provide evidence they have applied for jobs. If they do not, the benefit may be temporarily cut. A number of

experiments support the notion that greater search requirements reduce the length of unemployment. One experiment conducted in Maryland assigned recipients to different processes ranging from

the standard requirement at the time of two employer contacts per week to requiring at least four contacts per week, attending a four-day job search workshop, and telling claimants that their

employer contacts would be verified. The results showed that increasing the number of employer contacts reduced the duration by 6%, attending the workshop reduced duration by 5%, and the

possibility of verification reduced it by 7.5%. Indeed, just telling claimants that they were going to have to attend the workshop led to a reduction in claimants. Evidence on instituting

some kind of work requirement is similar to that of instituting workshop attendance.

The authors conclude that the effectiveness of all these instruments results from the fact that they encourage more active job search.

Source: Peter Fredriksson and Bertil Holmlund, “Improving Incentives in Unemployment Insurance: A Review of Recent Research,” Journal of Economic

Surveys 20, no. 3 (July 2006): 357–86.

ANSWER TO TRY IT! PROBLEM

The duration of an unemployed worker’s job search increases in situation (a) and decreases in situations (b) and (c). Thus, the unemployment rate increases in (a) and decreases in (b) and

(c).

- 3522 reads