An understanding of economic efficiency is greatly facilitated as a result of understanding two related measures: consumer surplus and producer surplus. Consumer surplus relates to the demand side of the market, producer surplus to the supply side. Producer surplus is also termed supplier surplus. These measures can be understood with the help of a standard example, the market for city apartments.

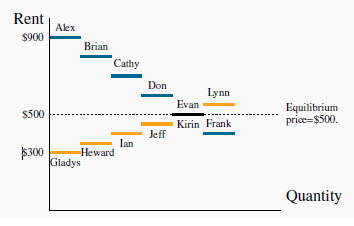

Table 5.1 and Figure 5.1 describe the hypothetical data. We imagine first a series of city-based students who are in the market for a standardized downtown apartment. These individuals are not identical; they value the apartment differently. For example, Alex enjoys comfort and therefore places a higher value on a unit than Brian. Brian, in turn, values it more highly than Cathy or Don. Evan and Frank would prefer to spend their money on entertainment, and so on. These valuations are represented in the middle column of Table 5.1, and also in Figure 5.1 with the highest valuations closest to the origin. The valuations reflect the willingness to pay of each consumer.

| Demand | ||

| Individual | Demand valuation | Surplus |

| Alex | 9 | 400 |

| Brian | 8 | 300 |

| Cathy | 7 | 200 |

| Don | 6 | 100 |

| Evan | 5 | 0 |

| Frank | 4 | 0 |

| Individual | Reservation value | Surplus |

| Gladys | 300 | 200 |

| Heward | 350 | 150 |

| Ian | 400 | 100 |

| Jeff | 450 | 50 |

| Kirin | 500 | 0 |

| Lynn | 550 | 0 |

Demanders and suppliers are ranked in order of the value they place on an apartment. The market equilibrium is where the marginal demand value of Evan equals the marginal supply value of Kirin at $500. Five apartments are rented in equilibrium.

On the supply side we imagine the market as being made up of different individuals or owners, who are willing to put their apartments on the market for different prices. Gladys will accept less rent than Heward, who in turn will accept less than Ian. The minimum prices that the suppliers are willing to accept are called reservation prices or values, and these are given in the lower part of Table 5.1. Unless the market price is greater than their reservation price, suppliers will hold back.

By definition, as stated in The classical marketplace – demand and supply, the demand curve is made up of the valuations placed on the good by the various demanders. Likewise, the reservation values of the suppliers form the supply curve. If Alex is willing to pay $900, then that is his demand price; if Heward is willing to put his apartment on the market for $350, he is by definition willing to supply it for that price. Figure 5.1 therefore describes the demand and supply curves in this market. The steps reflect the willingness to pay of the buyers and the reservation valuations or prices of the suppliers.

In this example, the equilibrium price for apartments will be $500. Let us see why. At that price the value placed on the marginal unit supplied by Kirin equals Evan’s willingness to pay. Five apartments will be rented. A sixth apartment will not be rented because Lynne will let her apartment only if the price reaches $550. But the sixth potential demander is willing to pay only $400. Note that, as usual, there is just a single price in the market. Each renter pays $500, and therefore each supplier also receives $500.

The consumer and supplier surpluses can now be computed. Note that, while Don is willing to pay $600, he actually pays $500. His consumer surplus is therefore $100. In Figure 5.1, we can see that each consumer’s surplus is the distance between the market price and the individual’s valuation. These values are given in the final column of the top half of Table 5.1.

Consumer surplus is the excess of consumer

willingness to pay over the market price.

Consumer surplus is the excess of consumer

willingness to pay over the market price.

Using the same reasoning, we can compute each supplier’s surplus, which is the excess of the amount obtained for the rented apartment over the reservation price. For example, Heward obtains a surplus on the supply side of $150, while Jeff gets $50. Heward is willing to put his apartment on the market for $350, but gets the equilibrium price/rent of $500 for it. Hence his surplus is $150.

Supplier or producer surplus is the excess of

market price over the reservation price of the supplier.

Supplier or producer surplus is the excess of

market price over the reservation price of the supplier.

It should now be clear why these measures are called surpluses. The suppliers and demanders are all willing to participate in this market because they earn this surplus. It is a measure of their gain from being involved in the trading.

- 瀏覽次數:3287