Regulating monopolistic sectors of the economy is one means of reducing their market power. In Imperfect competition it was proposed that indefinitely decreasing production costs in an industry means that the industry might be considered as a

‘natural’ monopoly: higher output can be produced at lower cost with fewer firms. Hence, a single supplier has the potential to supply the market at a lower unit cost; unless, that is, such a

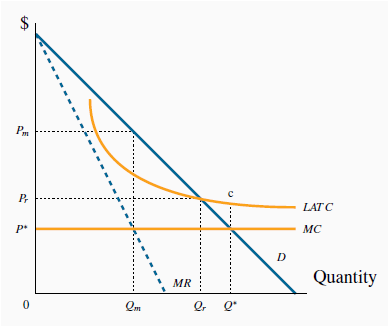

single supplier uses his monopoly power. To illustrate how the consumer side may benefit from this production structure through regulation, consider Figure 14.4. For simplicity suppose that long-run marginal costs are

constant and that average costs are downward sloping due to an initial fixed cost. The profit-maximizing (monopoly) output is where MR = MC at  and is sold at the price Pm. This output is inefficient

because the willingness of buyers to pay for additional units of output exceeds the additional cost. On this criterion the efficient output is Q*. But LATC exceeds price at Q*, and therefore it

is not feasible for a producer.

and is sold at the price Pm. This output is inefficient

because the willingness of buyers to pay for additional units of output exceeds the additional cost. On this criterion the efficient output is Q*. But LATC exceeds price at Q*, and therefore it

is not feasible for a producer.

The profit-maximizing output is  ,

whereMR=MC and price is

,

whereMR=MC and price is  . This output is inefficient because marginal

benefit is greater than MC. Q* is the efficient output, but results in losses because LATC > P at that output. A regulated price that covers costs is where LATC = D. This is closer to the

efficient output Q* than the monopoly output

. This output is inefficient because marginal

benefit is greater than MC. Q* is the efficient output, but results in losses because LATC > P at that output. A regulated price that covers costs is where LATC = D. This is closer to the

efficient output Q* than the monopoly output  .

.

One solution is for the regulating body to set a price-quantity combination of  , and

, and  ,

where price equals average cost and therefore generates a normal rate of profit. This output level is still lower than the efficient output level Q*, but is more efficient than the

profit-maximizing output

,

where price equals average cost and therefore generates a normal rate of profit. This output level is still lower than the efficient output level Q*, but is more efficient than the

profit-maximizing output  . It is more

efficient in the sense that it is closer to the efficient output Q*. A problem with such a strategy is that it may induce lax management or overpayment to the factors of production: if

producers are allowed to charge an average cost price, then there is a reduced incentive for them to keep strict control of their costs in the absence of competition in the marketplace.

. It is more

efficient in the sense that it is closer to the efficient output Q*. A problem with such a strategy is that it may induce lax management or overpayment to the factors of production: if

producers are allowed to charge an average cost price, then there is a reduced incentive for them to keep strict control of their costs in the absence of competition in the marketplace.

A second solution to the declining average cost phenomenon is to implement what is called a twopart tariff. This means that customers pay an ‘entry fee’ in order to be able to purchase the good. For example, telephone subscribers may pay a fixed charge per month for their phone and then may pay an additional charge that varies with use. In this way it is possible for the supplier to charge a price per unit of output that is closer to marginal cost and still make a profit, than under an average cost pricing formula. In terms of Figure 14.4, the total value of entry fees, or fixed components of the pricing, would have to cover the difference between MC and LATC times the output supplied. In Figure 14.4 this implies that if the efficient output Q* is purchased at a price equal to the MC the producer loses the amount (c-MC) on each unit sold. The access fees would therefore have to cover at least this value.

Such a solution is appropriate when fixed costs are high and marginal costs are low. This situation is particularly relevant in the modern market for telecommunications: the cost to suppliers of marginal access to their networks, whether it be for internet, phone or TV, is negligible compared to the cost of maintaining the network and installing capacity.

Two-part tariff: involves an access fee and a per

unit of quantity fee.

Two-part tariff: involves an access fee and a per

unit of quantity fee.

Finally, a word of caution: Nobel Laureate George Stigler has argued that there is a danger of regulators becoming too close to the regulated, and that the relationship can evolve to a point where the regulator may protect the regulated firms. A likely such case was Canada’s airline industry in the seventies.

KEY TERMS

Market failure defines outcomes in which the allocation of resources is not efficient.

Public goods are non-rivalrous, in that they can be consumed simultaneously by more than one individual; additionally they may have a non-excludability characteristic.

Efficient supply of public goods is where the marginal cost equals the sum of individual marginal valuations, and each individual consumes the same quantity.

Asymmetric information is where at least one party in an economic relationship has less than full information and has a different amount of information from another

party.

Adverse selection occurs when incomplete or asymmetric information describes an economic relationship.

Moral hazard may characterize behaviour where the costs of certain activities are not incurred by those undertaking them.

Predatory pricing is a practice that is aimed at driving out competition by artificially reducing the price of one product sold by a supplier.

Refusal to deal: an illegal practice where a supplier refuses to sell to a purchaser.

Exclusive sale: where a retailer is obliged (perhaps illegally) to purchase all wholesale products from a single supplier only.

Tied sale: one where the purchaser must agree to purchase a bundle of goods from the one supplier.

Two-part tariff: involves an access fee and a per unit of quantity fee.

EXERCISES

- An economy is composed of two individuals, whose demands for a public good – street lighting – are given by P - 12(1/2)Q and P = 8 - (1/3)Q.

- Graph these demands on a diagram.

- Derive the total demand for this public good by summing the demands vertically, and write down a resulting equation for this demand curve.

- Let the marginal cost of providing the good be $5 per unit. Find the efficient supply of the public good in this economy – where the marginal cost equals the total value of a marginal unit.

- In the previous question, suppose a new citizen joins the economy, and her demand for the public good is given by P = 10 - (5/12)Q.

- Derive the new demand for the public good on the part of the whole economy and compute the new optimal level of supply, given that the MC remains unchanged.

- Calculate the total value to the consumers of the amount supplied at this efficient output level.

- Compute the net value to society of that choice – the total value minus the total cost.

- An industry that is characterized by a decreasing cost structure has a demand curve given by P = 100 - Q and the marginal revenue curve by MR = 100 - 2Q. The marginal cost is

MC = 4, and average cost is AC = 4+188=Q.

- Graph this cost and demand structure.

- Calculate the efficient output and the monopoly output for the industry.

- What price would the monopolist charge if he were unregulated, and what would be his profit per unit?

- Instead of having a monopoly the government decides to regulate this supplier in the interests of the consumer.

- What price and output would emerge if the supplier were regulated so that his allowable price equalled average cost?

- Compute the value of the deadweight loss associated with having an unregulated monopoly relative to having a regulated monopoly where a price is permitted that covers ATC.

- As an alternative to regulating the supplier such that price covers average total cost, suppose that a two part tariff were used to generate revenue. This scheme involves charging the MC for each unit that is purchased and in addition charging each buyer in the market a fixed cost that is independent of the amount he purchases. If an efficient output is supplied in the market, estimate the total revenue to be obtained from the component covering a price per unit of the good supplied, and the component covering fixed cost.

- 瀏覽次數:3355