We can grasp the key features of the market for capital by recognizing that the flow of capital services is determined by the capital stock: more capital means more services. The analysis of supply is complex because we must distinguish between the long run and the short run, and also between the supply to an industry and the supply in the whole economy.

In the short run the total supply of capital assets, and therefore services, is fixed to the economy, since new production capacity cannot come on stream overnight: the short run supply of services is therefore vertical. In contrast, a particular industry in the short run faces a positively sloped supply: by offering a higher rental rate for trucks, one industry can bid them away from others.

The long run is a period of sufficient length to permit an addition to the capital stock. A supplier of capital, or capital services, must estimate the likely return he will get on the equipment he is contemplating having built. To illustrate, suppose an earthmover costs $100,000, and the annual maintenance and depreciation costs are $10,000. In addition the interest rate is 5%, and therefore the cost of borrowing the money to invest in this machinery is $5,000 per annum. It follows that the annual cost of owning such a machine is $15,000. If this entrepreneur is to undertake the investment he must therefore earn at least this amount annually, and this is what is termed the required rental. We can think of it as the opportunity cost of ownership.

The required rental covers the sum of maintenance,

depreciation and interest costs.

The required rental covers the sum of maintenance,

depreciation and interest costs.

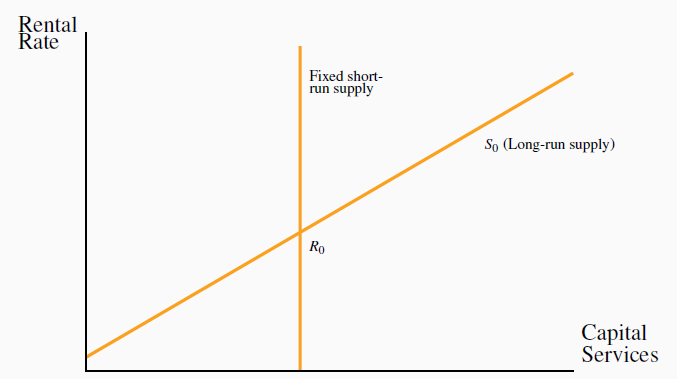

In the long run, capital services in any sector of the economy must earn the required rental. If they earn more, entrepreneurs will be induced to build or purchase additional capital goods; if they earn less, owners of capital will allow machines to depreciate, or move the machines to other sectors of the economy. Figure 12.7 depicts the long run supply of capital to the economy, So. It is upward sloping, reflecting the fact that higher returns to capital (rentals) induce a greater supply. In this figure the rental rate in the economy is given by the value Ro. This can be thought of as the typical return on capital in the whole economy.

In the short run the stock of capital, and therefore the supply of capital services, is fixed. In the long run a higher return will induce suppliers to produce more capital goods, or capital goods may enter the economy from other economies. Ro is the current return to capital in the economy – given by where the demand for capital (or its services) intersects the given supply curve in the short run.

What are the mechanics of an upward-sloping supply of capital in the economy? If the return to capital is high capital might enter the economy from abroad. Alternatively, keeping in mind that capital goods ultimately must be produced, entrepreneurs in the economy may decide that it is more profitable to produce capital goods than consumer goods if the returns warrant it.

The point Ro is the current return to capital in the economy – given by where the demand for capital (or its services) intersects the given supply curve in the short run.

- 瀏覽次數:1757