In recent years the prices of residential housing have been rising at the same time as conventional mortgage interest rates have been low and falling relative to earlier time periods. These changes might be unrelated, each arising from some other conditions, or they might be related with rising housing prices pushing interest rates down, or perhaps low and falling mortgage rates push housing prices up. Each is a possible hypothesis or theory about the relationship between house prices and interest rates.

An economist would choose the third explanation based on economic logic. Mortgage rates determine the cost of financing the purchase of a house. A lower mortgage rate means lower monthly payments per dollar of financing. As a result buyers can purchase higher priced houses for any given monthly payment. Low and falling mortgage rates allow potential buyers to offer higher prices and potential sellers to expect higher prices. Lower mortgage rates may be an important cause of higher house prices. The reverse argument follows, namely that rising mortgage rates would cause lower house prices. In general terms, house prices are inversely related to mortgage interest rates.

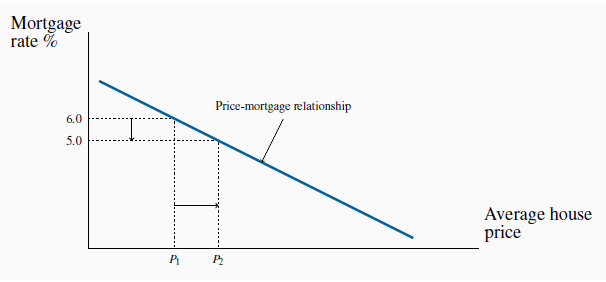

A two dimensional diagram such as Figure 2.1 is an effective way to illustrate this basic model. Mortgage interest rates are measured on the vertical axis. Average house prices are measured on the

horizontal axis. The downward sloping line in the diagram illustrates the inverse relationship between a change in mortgage rates and house prices predicted by the model. In the diagram, a fall

in mortgage rates from 6.0 percent to 5.0 percent raises average house prices from  to

to  .

.

Of course this model is very simple and naive. It formalizes an essential economic element of the theory. House prices may also depend on other things such as population growth and urbanization, new house construction, rental rates, family incomes and wealth, confidence in future employment and economic growth and so forth. By concentrating on interest rates and house prices the model argues that this relationship is the key explanation of short term changes in house prices. Other factors may be important but they evolve and change more slowly than mortgage rates.

A model reduces and simplifies. Its focus is on the relationship the economist sees as the most important. In this example it assumes that things other than the mortgage rate that might affect house prices are constant. A change in one or more of the conditions assumed constant might change house prices at every interest rate. That would mean a change the position of the mortgage rate-house price line but not the basic mortgage rate-house price relationship.

The mortgage rate-house price model can also be illustrated using simple algebra. Equation 2.1 describes average house price  in terms of a constant

in terms of a constant  and the mortgage rate MR.

and the mortgage rate MR.

(2.1)

The negative sign in the equation defines the inverse relationship between house prices and mortgage rates suggested by the model. A fall in the mortgage rate MR would cause an increase in the

average house price  .

.

The size of the change in the average house price caused by a change in the mortgage rate is measured by the parameter b in the equation. We argue that the sign attached to b is negative and of that b is significantly large, but that argument needs to be tested. A model is only useful if the economic relationship it defines is supported by actual observations. Observations generate the facts or data needed for the conception and testing of a model.

- 瀏覽次數:3014