Average real GDP figures tell us nothing about how GDP is shared in an economy. They tell us how big the pie is but not who has the largest and smallest slices. Economists therefore also look at other measures that tell us about the economic environment as it is experienced by workers and households.

Wages in an economy provide a sense of how workers are doing. However, the wage in dollars—the nominal wage—is not the best indicator. While salaries and pay scales for jobs are quoted in dollar terms, decisions on whether or not to take a job and how many hours to work at that job depend on what those dollars can buy in terms of goods and services. If all prices in the economy were to double, then $10 would buy only half as much as it used to, so a job paying $10 an hour would seem much less attractive than it did before.

For this reason, we instead look at the real wage in the economy. As with real GDP, real here refers to the fact that we are correcting for inflation. It is real wages—not nominal wages—that tell us how an economy is doing. To convert nominal wages to real wages, we need a price index, and because we are looking at how much households can buy with their wages, we usually choose the Consumer Price Index (CPI) as the index.

Toolkit: Section 16.1 "The Labor Market"

The real wage is the wage corrected for inflation. To obtain the real wage, simply divide the wage in dollars—the nominal wage—by the price level:

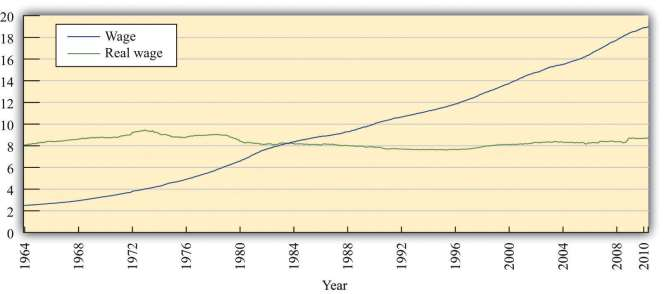

Figure 3.17 Real and Nominal Wages shows the nominal (hourly) wage paid to private sector industrial workers from 1964 to 2010. Over this period, the nominal wage rate increased almost eightfold from a low of $2.50 in January 1964 to nearly $19.00 by the end of the period. 1 The real wage series in Figure 3.17 Real and Nominal Wages shows the nominal wage divided by the CPI (times 100 so that the real and nominal wages are equal in the base year of the CPI). The nominal wage increased over this period by over five times, but the real wage actually decreased at times. It peaked at near $9.50 in 1973, decreased to $7.62 in 1995, and has risen only slowly since that time.

It is a remarkable fact that, even though US real GDP is now more than 150 percent greater than it was in the early 1970s, real wages are still significantly lower than they were at that time. What is going on here? Part of the story is that other forms of nonwage compensation have become increasingly significant over the past few decades. The most important of these are health-care benefits. When these and other benefits are included, we find that overall compensation has increased reasonably steadily and is about 50 percent greater now than in the early 1970s. 2Total compensation is, in fact, a better measure than real wages. Even so, total compensation has been increasing at a far slower rate than real GDP over the last few decades.

- 2328 reads