The excerpts at the beginning of this chapter reveal that the financial crisis also impacted other countries. For example, we included an excerpt about the effects of the crisis on the value of a dollar and also an excerpt about exports from China. We could have also cited effects of the crisis on other countries: for example, India’s information technology sector and Canada’s lumber industry were both affected. To understand the transmission of the crisis to other countries, we have to learn about another market—the market where different currencies are bought and sold.

If you travel abroad, you must acquire the currency used in that region of the world. For example, if you take a trip to Finland, Russia, and China, you will buy euros, rubles, and yuan along the way. To do so, you need to participate in various foreign exchange markets.

Toolkit: Section 16.10 "Foreign Exchange Market"

The foreign exchange market is the market where currencies are traded. The price in this market is the price of one currency in terms of another and is called the nominal exchange rate.

Dollars are supplied to foreign exchange markets by US households, firms, and governments who wish to purchase goods, services, or financial assets that are denominated in the currency of another economy. For example, if a US auto importer wants to buy a German car, it must sell dollars and buy euros. As the price of a dollar increases, the quantity supplied of that currency will increase.

Foreign currencies are supplied by foreign households, firms, and governments that wish to purchase goods, services, or financial assets (such as stocks or bonds) denominated in the domestic currency. For example, if a Canadian bank wants to buy a US government bond, it must sell Canadian dollars and buy US dollars. The law of demand holds: as the price of a dollar increases, the quantity of that currency demanded decreases.

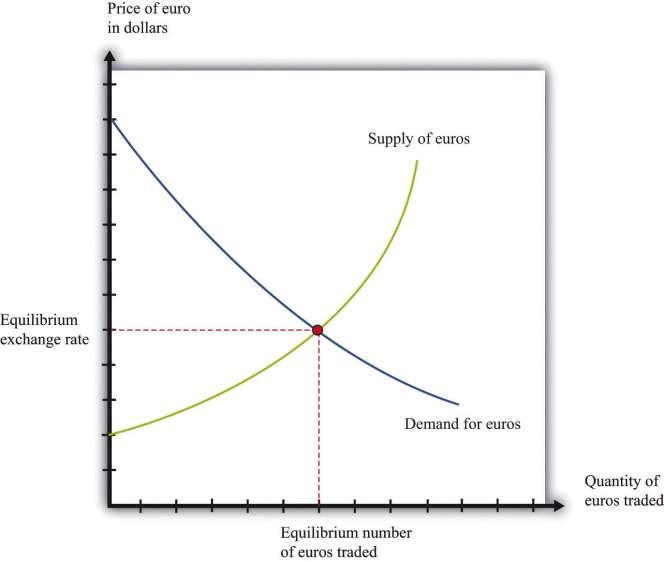

***Figure 4.13 "Equilibrium in the Foreign Exchange Market Where Dollars and Euros Are Exchanged" shows an example of a foreign exchange market: the market in which euros are bought with and sold for US dollars. The horizontal axis shows the number of euros bought and sold on a particular day. The vertical axis shows the exchange rate—the price of a euro in dollars. This market determines the dollar price of euros just like the gasoline market determines the dollar price of gasoline.

On the supply side, there are households and firms in Europe who want to buy US goods and services. To do so, they need to buy dollars and, therefore, must supply euros to the market. This supply of euros need not come only from European households and firms. Anyone holding euros is free to sell them in this market. On the demand side, there are households and firms who are holding dollars and who wish to buy European goods and services. They need to buy euros.

There is another source of the demand for and the supply of different currencies. Households and, more importantly, firms often hold assets denominated in different currencies. You could, if you wish, hold some of your wealth in Israeli government bonds, in shares of a South African firm, or in Argentine real estate. But to do so, you would need to buy Israeli shekels, South African rand, or Argentine pesos. Likewise, many foreign investors hold US assets, such as shares in Dell Inc. or debt issued by the US government. Thus the demand for and the supply of currencies are also influenced by the asset choices of households and firms. In practice, banks and other financial institutions conduct the vast majority of trades in foreign exchange markets.

As well as households and firms, monetary authorities also participate in foreign exchange markets. For example, the US Federal Reserve Bank monitors the value of the dollar and may even intervene in the market, buying or selling dollars in order to influence the exchange rate.

- 1703 reads