Imagine that we are comparing two countries that are identical in almost every respect. They both have the same levels of technology and human capital and the same balanced-growth ratio of capital stock to GDP. However, they have different amounts of physical capital. Suppose that one of the countries has a large capital stock (call it the rich country) and the other country has a much smaller capital stock (call it the poor country).

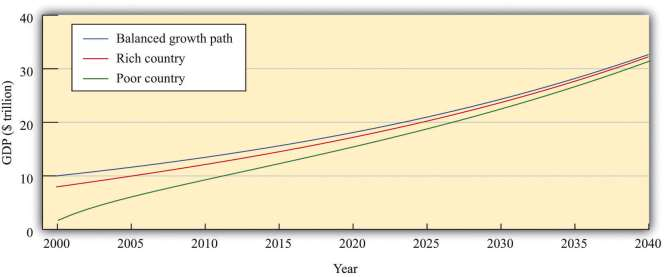

These two economies will initially have different levels of output and living standards. Our model predicts, however, that these differences will be temporary. Both economies will approach the balanced-growth path. The poor country will grow more rapidly because its ratio of capital stock to GDP will be increasing more quickly as it moves toward the balanced-growth path. Over time, we expect to see the poor country catch up to the rich one. We illustrate this in ***Figure 6.15 "Convergence of a Rich Country and a Poor Country".

This is exactly the same mechanism for convergence that we saw before. The country with a smaller capital stock will have a higher marginal product of capital and will grow faster because the country is a more attractive place for investment. Because the poor country accumulates capital more rapidly than the richer country, it will grow faster. The two countries will converge to the same balanced-growth path and to the same level of output per person.

- 1410 reads