Reserve requirements are outlined in Section 19 (A) of the Federal Reserve Act:

(A) Each depository institution shall maintain reserves against its transaction accounts as the Board may prescribe by regulation solely for the purpose of implementing monetary policy—

- in the ratio of 3 per centum for that portion of its total transaction accounts of $25,000,000 or less, subject to subparagraph (C); and

- in the ratio of 12 per centum, or in such other ratio as the Board may prescribe not greater than 14 per centum and not less than 8 per centum, for that portion of its total transaction accounts in excess of $25,000,000, subject to subparagraph (C) [which stipulate that the reserve requirements could be changed].

Suppose the Fed were to increase the reserve requirement from 10 percent to 20 percent. In the previous example, all else being the same, a bank with deposits of $1,000 would be required to have at least $200 on deposit, rather than the $100 that was required originally. To fulfill this larger reserve requirement, the bank would be allowed to lend only $800 at most. Banks therefore respond to an increase in the reserve requirement by holding a larger fraction of deposits on reserve and lending out a smaller fraction of their deposits. This reduces the supply of credit in the economy since a smaller fraction of saving is actually being lent.

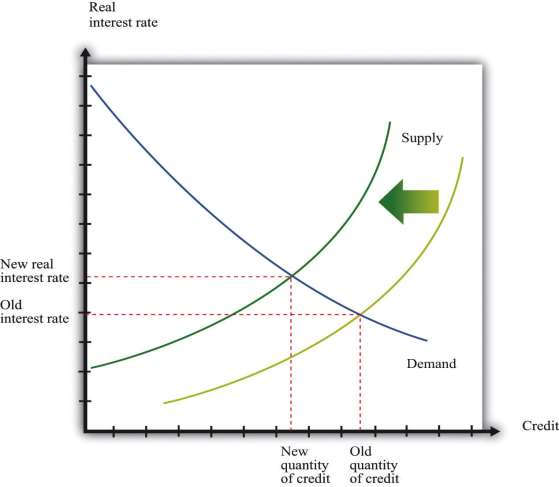

As shown in ***Figure 10.22 "An Increase in Reserve Requirements", the supply of credit shifts inward, and the interest rate increases. This picture is exactly the same as ***Figure 10.21 "An Increase in the Discount Rate". When we think about the credit market, the increase in the discount rate and the increase in the reserve requirement have the same effect. Thus we learn that the Fed can increase interest rates by increasing the reserve requirement. Often, increases in the reserve requirement are coupled with other measures, such as open-market operations, to increase interest rates. A decrease in the reserve requirement works in a symmetric fashion, though in the opposite direction.

KEY TAKEAWAY

Banks act as intermediaries, taking the deposits of households and making loans to firms and households who wish to borrow. Banks also borrow from other banks and from the Fed.

The main tools of the Fed are as follows: (a) open-market operations, (b) lending at the discount rate to member banks, and (c) setting the reserve requirements on member banks.

***

Checking Your Understanding

Can a bank borrow from the Fed?

What are reserve requirements?

In an open market sale, does the money supply increase or decrease?

- 2129 reads