Why is it that, contrary to what ***Figure 6.8 "Convergence through the Accumulation of Capital" seems to suggest, not all countries converge? The logic of that picture rests on the diminishing marginal product of capital. If rich countries have lower marginal product of capital than poor countries, then we expect poor countries to catch up. If, for some reason, richer countries sometimes also have a higher marginal product of capital than poorer countries, then the argument for convergence disappears.

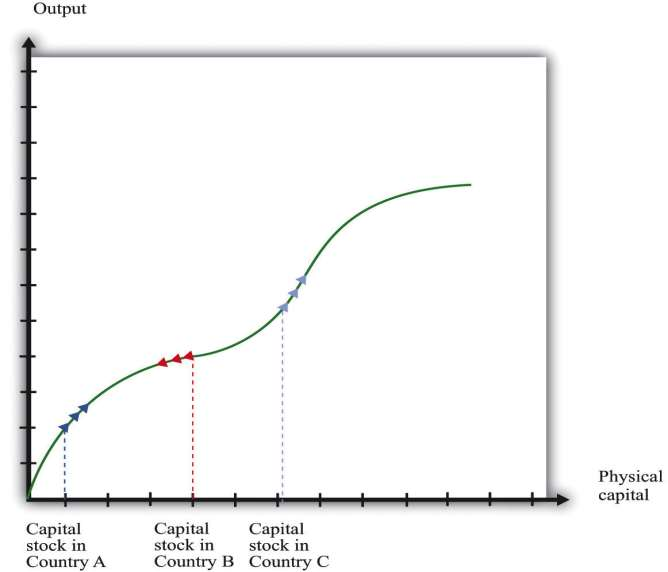

***Figure 6.11 "Divergence Arising from Increasing Marginal Product of Capital" shows an example where the aggregate production function looks a bit different. This production function has a range where increases in capital stock lead to a higher rather than a lower marginal product of capital. That is, for some amounts of capital, we see increasing marginal product of capital rather than diminishing marginal product of capital. In the figure, country A and country B converge, just as in our previous diagram. But country C is rich enough to lie on the other side of the range where there is an increasing marginal product of capital. Country C therefore has a higher marginal product of capital than country B, even though country C is richer. Countries B and C will diverge, rather than converge.

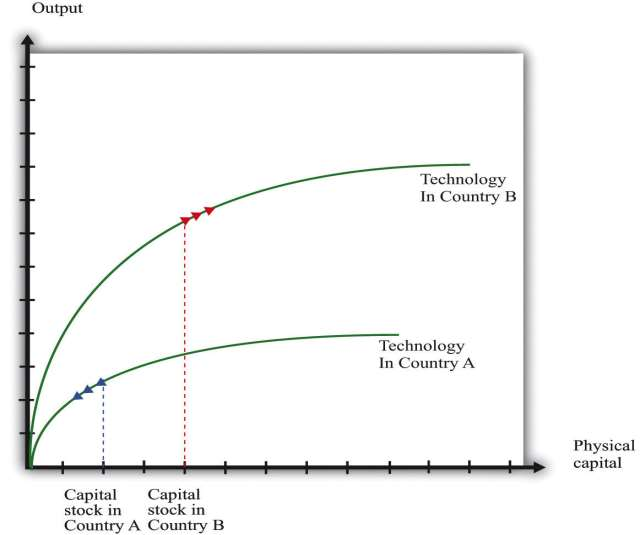

***Figure 6.12 "Divergence Arising from Differences in Technology" shows another reason why a richer country might have a higher marginal product of capital than a smaller country. In ***Figure 6.8 "Convergence through the Accumulation of Capital" we supposed that the three countries had the same production function and differed only in terms of their capital stock. In ***Figure 6.12 "Divergence Arising from Differences in Technology", country B is richer than country A for two reasons: it has more capital and has a superior technology (or more labor or human capital). The higher capital stock, other things being equal, means a lower marginal product of capital in country B. But the superior technology, other things being equal, means a higher marginal product of capital in country B. In the picture we have drawn, the technology effect dominates. Country B has the higher marginal product of capital, so it is the more attractive location for capital—it is more competitive. Because of this, the capital stock increases in country B. Indeed, if the only factor driving investment is the marginal product of capital, then we would expect capital to flow among countries until the marginal product of capital is equal everywhere. [***We discuss capital migration across countries in more detail in Chapter 5 "Globalization and Competitiveness".***]

One reason why a richer economy might have better technology is because it has better social infrastructure. In particular, developed economies often have the legal and cultural institutions that preserve property rights. The return on investment is higher, other things being equal, when property rights are protected. In economies with less well-developed institutions, investors need a higher rate of return to compensate them for the additional risk of placing their capital in those countries.

Measuring these aspects of social infrastructure is a challenge. The World Bank has attempted to do so in its 2005 World Development Report. [***World Bank, World Development Report 2005: A Better Investment Climate for Everyone(New York: World Bank and Oxford University Press, 2004), 8, accessed August 22, 2011,http://siteresources.worldbank.org/INTWDR2005/Resources/complete_report.pdf.

Saylor URL: http://www.saylor.org/books Saylor.org ***] The study looks at various aspects of doing business in 48 countries. The top constraints on investment reported by firms were policy uncertainty, macroeconomic instability, and taxes. Many of the risks of doing business are directly associated with government action in the present and in the future. This is nicely stated in the World Bank report: “Because investment decisions are forward looking, firms’ judgments about the future are critical. Many risks for firms, including uncertain responses by customers and competitors, are a normal part of investment, and firms should bear them. But governments have an important role to play in maintaining a stable and secure environment, including by protecting property rights. Policy uncertainty, macroeconomic instability, and arbitrary regulation can also cloud opportunities and chill incentives to invest. Indeed, policy-related risks are the main concern of firms in developing countries.” [***World Bank, World Development Report 2005: A Better Investment Climate for Everyone(New York: World Bank and Oxford University Press, 2004), 5, accessed August 22, 2011,http://siteresources.worldbank.org/INTWDR2005/Resources/complete_report.pdf.***]

KEY TAKEAWAY

Capital stock increases from investment and decreases due to the depreciation of capital stock.

All else being the same, poorer countries have a lower capital stock and therefore a higher marginal product of capital compared to rich countries. Thus capital accumulation should be faster in poor countries, which will lead to convergence with richer countries.

The evidence suggests convergence between some but not all economies.

Divergence of output across countries might come from the presence of an increasing marginal product of capital or from one country having a superior technology to another.

***

Checking Your Understanding

Suppose we have 100 units of capital stock at the beginning of 2012 and the following table gives the investment for the next 5 years. Suppose the depreciation rate is 5 percent. Fill in the blanks in the table for the years 2012–2017.

|

Year |

Capital Stock (Start of Year) |

Investment |

Depreciation |

|

2012 |

100 |

80 |

|

|

2013 |

20 |

||

|

2014 |

50 |

||

|

2015 |

120 |

||

|

2016 |

10 |

If one country has a higher level of real GDP than another, does that mean it must have a higher growth rate as well?

If citizens of a relatively poor country are educated in a richer country, does this help or hinder convergence?

- 1458 reads